Turkey’s Economy Beats Expectations: Growth Up But Risks Loom

In the second quarter of 2025, Turkish GDP rose 4.8% year-on-year, which crossed the market consensus of 4.1% and our forecast of 3.8%. Today we will discuss about Turkey’s Economy Beats Expectations: Growth Up But Risks Loom

Turkey’s Economy Beats Expectations: Growth Up But Risks Loom

In 2025, Turkey’s economy has delivered a welcome surprise: growth has outpaced many forecasts, fueled by robust domestic demand, strong private consumption, and resilient investment. However, the headline gains mask underlying vulnerabilities—persistent inflation, external financing needs, political uncertainty, and structural imbalances that could derail the momentum.

This article takes a detailed look at how Turkey’s economy outperformed expectations, what has driven the surprise, and—critically—what risks lie ahead. We assess macro indicators, policy responses, structural challenges, and scenario risks.

1. Recent Performance: A Stronger-than-Expected Turnaround

1.1 Growth outpacing forecasts

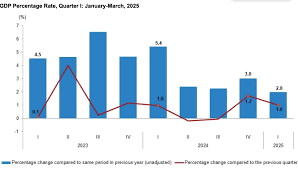

Data for Q2 2025 revealed that Turkey’s GDP grew by 4.8 % year-on-year, significantly above the consensus of ~4.1 % and surpassing internal forecasts of 3.8 %. This was a clear signal that the economy had reaccelerated after a mixed performance in previous quarters.

For the first half of 2025, cumulative growth reached ~3.3 %, benefitting in part from upward revisions of earlier quarters (e.g. Q1 was revised from 2.0 % to 2.3 %).

Because of this stronger momentum, several institutions have moved their growth forecasts upward. For example:

The European Bank for Reconstruction and Development (EBRD) upgraded Turkey’s 2025 GDP forecast from 2.8 % to 3.1 %.

The World Bank expects a stable 3.1 % growth in 2025 (after 3.2–3.3 % in 2024) underpinned by tighter monetary policy and fiscal discipline.

The OECD notes that though growth may moderate, the normalization of macro policy is helping stabilize sentiment.

BBVA’s June 2025 outlook keeps a somewhat more optimistic view: 3.5 % growth in 2025 and 4.0 % in 2026.

Thus, while forecasts still show moderation relative to past booms, the upward revisions reveal that the Turkish economy has surprised on the upside.

1.2 Drivers of the surprise

What is fueling this stronger performance?

Robust Private Consumption

Household spending remained resilient even under tighter financial conditions. In Q2 2025, private consumption made a sizable contribution to overall growth.Investment Bouncing Back

Fixed investment, especially in construction, infrastructure, and machinery, regained strength. Some of this rebound reflects base effects and the carryover of projects from earlier stimulus phases.Policy Rebalancing & Stabilization

Turkey’s authorities have increasingly shifted toward macroeconomic normalization. That includes a more orthodox monetary stance (raising rates earlier, then cautious cuts), attempts at fiscal consolidation (or at least restraint), and tighter controls on credit. The aim: anchor inflation expectations and stabilize financial markets.Revisions and Statistical Base Effects

Some of the upside owes to upward revisions in past data and favorable base effects, making growth comparisons more positive.

Overall, the growth surprise is not purely cyclical or transitory; it reflects a mix of underlying momentum and policy realignment.

2. Macro Fundamentals: Strengths & Stress Points

To evaluate whether this growth is durable (or dangerously inflated), one must assess the current macro fundamentals. Below is a mix of encouraging signs and red flags.

2.1 Inflation & monetary policy

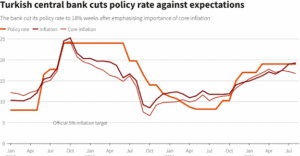

Inflation has long been Turkey’s Achilles’ heel. Earlier, unorthodox low-rate policies led inflation to spike to levels above 80 %. In recent times, the central bank and government have sought to tame price pressures.

As of mid-2025, inflation has moderated, falling below 40 % in some months.

In early 2025, the central bank cut its benchmark rate from 50 % downward (to about 45 %) as inflation softened.

However, in periods of volatility, the central bank has reversed course—raising the rate back to 46 % amid political turbulence and inflationary pressures (especially from administered prices or core inflation).

Turkey’s medium-term economic program (2025–2027) currently targets inflation at 28.5 % by end-2025, 16 % in 2026, and single digits by 2027. The success of this disinflation path will hinge on credibility, consistent policy, and structural reforms.

A risk: real interest rates remain volatile, and further cuts—even if inflation declines—could reignite inflation expectations and currency pressures.

2.2 Fiscal and public finances

Turkey’s fiscal deficit has hovered around 5 % of GDP, driven by rising expenditures and lagging revenues. The post-earthquake reconstruction spending added strain, making consolidation more challenging.

The authorities aim to reduce the deficit via expenditure restraint, but delays in structural reforms or political resistance could stall this effort.

Public debt levels are moderate relative to many peers, but Turkey’s dependence on external borrowing (particularly short-term foreign-currency debt) increases sensitivity to global funding shocks.

2.3 External sector & financing

Turkey has long run a structural current account deficit, financed by capital inflows. In recent years, that deficit has narrowed, helped by a fall in imports and inflows into Turkish assets.

Still, Turkey’s external vulnerability remains significant:

Large short-term external financing needs leave the country exposed to sudden stops or capital flight. EBRD flagged this as a key risk.

A real appreciation of the Turkish lira, while helpful to curb inflation, undermines export competitiveness.

Foreign-denominated debt in the private sector remains elevated; if the lira depreciates, debt servicing costs jump.

Thus, external financing is a watchpoint: if global rates rise or investor sentiment sours, Turkey could face balance-of-payment stress.

2.4 Structural challenges: mismatch, inequality, productivity

Growth driven by consumption and investment is positive, but Turkey must tackle longer-term structural constraints:

Productivity & industrial mix: Empirical research underscores the strong link between manufacturing output (especially heavy industries) and GDP growth in Turkey—as opposed to overreliance on low-productivity sectors.

Inequality & inclusive growth: Growth alone does not guarantee equitable outcomes. Studies suggest that unless public investment in education, health, and human capital is strengthened, inequality may widen.

Energy & environmental risks: Turkey’s industrial expansion is pushing up energy demand—and emissions. While nearshoring is creating new manufacturing clusters, the environmental cost is rising (electricity demand is surging).

Dependency on external inputs & value chains: Some sectors are vulnerable because of dependency on imported raw materials, energy, and intermediate goods. A weaker lira would raise input costs even if exports remain competitive.

2.5 Political and institutional risk

No macro story of Turkey can ignore politics. In 2025, the detention of Istanbul Mayor Ekrem İmamoğlu—a significant opposition figure—triggered sharp market volatility, a lira slide, and CDS widening.

S&P warned that these political tensions might undermine reforms, investor confidence, and currency stability.

Moreover, unpredictable policy shifts, interference in institutions, and weak commitment to structural reform could erode credibility and erode foreign investor appetite over time.

3. Risks & Scenarios

Given the mixed backdrop, Turkey’s economic trajectory is uncertain. Below are key downside and upside risks, along with possible scenarios.

3.1 Downside risks

Inflation resurgence & monetary credibility loss

If core inflation or administered prices rise sharply, the central bank may struggle to maintain real interest rates, forcing rate hikes or compromising disinflation efforts.External shock / capital flight

A global shock (e.g. U.S. rate hikes, credit squeeze, geopolitical tensions) could trigger capital outflows, depreciating the lira and spiking debt servicing burdens.Slippage in fiscal discipline

If government spending overruns or tax collection fails, the fiscal position might deteriorate, putting pressure on debt markets.Political blowback

Continued confrontation with opposition, weak institutional checks, or electoral uncertainty could spook markets.Structural stagnation

Failure to make progress on productivity-enhancing reforms, labor market flexibility, energy transition, or technology adoption could cap growth over the medium term.

3.2 Upside risks / tail possibilities

External tailwinds & FDI surge

If Turkey successfully draws foreign direct investment via nearshoring (given strategic location between Europe and Asia), that could boost exports and productivity.Improved EU / Western relations

A thaw in geopolitical tensions and trade integration (e.g. customs union reform, trade deals) could enhance investor confidence and market access.Technology & industrial upgrading

Accelerated adoption of automation, digitalization, and higher-value manufacturing could raise potential growth beyond current projections.Energy transition dividend

A shift toward renewables and better energy efficiency could lower import bills, reduce emissions, and improve competitiveness.

3.3 Plausible growth scenarios (2025–2027)

Base / baseline scenario

Growth moderates to ~3.0–3.5 %, with inflation falling gradually to low double digits. Turkey navigates external pressures but remains vulnerable to financing shocks.Optimistic / structural turnaround scenario

Structural reforms, improved relations, and foreign investment drive growth to 4.0–5.0 %, with inflation in single digits by 2027.Downside / stress scenario

Inflation resurges, capital outflows accelerate, policy credibility weakens, and growth stagnates below 2 % or worse.

Much depends on the consistency and credibility of macro policy, institutional reform, and external conditions.

4. Policy Imperatives & Recommendations

To sustain and deepen the positive surprise, Turkey must act on several fronts:

4.1 Anchor disinflation via credible monetary policy

Maintain independence of the central bank and resist political pressure for premature rate cuts.

Use forward guidance and communication to anchor inflation expectations.

Tighten credit rules and manage money supply growth prudently.

4.2 Fiscal discipline and revenue mobilization

Reform tax administration, broaden base, and improve collection efficiency.

Prioritize capital spending with high multipliers (infrastructure, green energy, R&D).

Avoid off-budget or quasi-fiscal operations that undermine credibility.

4.3 External buffer & capital flow management

Build up foreign exchange reserves to cushion against external shocks.

Encourage foreign participation in bond markets (e.g. via USD or euro-denominated instruments).

Use macroprudential tools to limit excessive leverage, especially in foreign-currency debt.

4.4 Structural reforms & productivity push

Invest in education, digital infrastructure, and vocational training.

Promote R&D, technology transfer, and high-value manufacturing clusters.

Reform labor markets and ease regulatory bottlenecks.

Accelerate energy transition—expand renewables, reduce reliance on fossil fuel imports.

4.5 Institutional strengthening & political stability

Reinforce rule of law, transparency, and checks and balances to improve investor confidence.

Engage with opposition and civil society to reduce political polarization.

Commit to long-term reform agendas that survive electoral cycles.

5. Conclusion

Turkey’s economic performance in 2025 is a story of resilience and upside surprises. Growth has outstripped many forecasts, buoyed by strong domestic demand, investment, and a shift toward more orthodox macroeconomic policy. But the gains remain fragile.

Inflation is still high, external financing risk looms, structural bottlenecks persist, and political developments create uncertainty. For Turkey to convert this temporary outperformance into sustained, inclusive growth, credibility, consistency, and bold reforms are essential.

If policymakers can stay the course, Turkey’s 2025 surprise may become the foundation for a more stable, higher-trajectory growth path. But if missteps or external shocks intervene, the upside could slip away. The coming months will test whether this growth is durable—or ephemeral.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

About the Author

usa5911.com

Administrator

Hi, I’m Gurdeep Singh, a professional content writer from India with over 3 years of experience in the field. I specialize in covering U.S. politics, delivering timely and engaging content tailored specifically for an American audience. Along with my dedicated team, we track and report on all the latest political trends, news, and in-depth analysis shaping the United States today. Our goal is to provide clear, factual, and compelling content that keeps readers informed and engaged with the ever-changing political landscape.