Stock Market Today: Tariff Shock, Tech Turbulence, Futures Dive

World stock markets are set for turmoil after Trump’s latest tariff shock. Stocks likely to suffer losses as precious metals are forecast to rise. Today we will discuss about Stock Market Today: Tariff Shock, Tech Turbulence, Futures Dive

Stock Market Today: Tariff Shock, Tech Turbulence, Futures Dive

Global financial markets are witnessing intense volatility as investors react to a fresh wave of trade tensions, sharp declines in technology stocks, and a steep fall in equity futures. The phrase “Stock Market Today” has once again become a symbol of uncertainty, reflecting a complex mix of political decisions, economic anxiety, and shifting investor sentiment. From Wall Street to Asian and European exchanges, risk appetite has weakened, safe-haven assets are gaining attention, and market participants are reassessing their strategies in light of a rapidly changing macroeconomic environment.

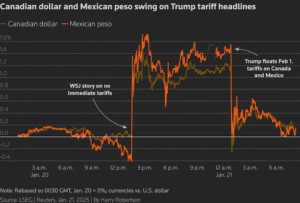

Tariff Shock Sends Ripples Across Markets

At the heart of today’s market turmoil lies renewed tariff pressure. The announcement of potential trade restrictions and higher import duties has reignited fears of a prolonged trade conflict. Markets are highly sensitive to tariffs because they directly affect corporate costs, global supply chains, and consumer prices. Even the possibility of new duties can disrupt earnings forecasts, force companies to revise growth plans, and slow cross-border commerce.

For multinational corporations, tariffs mean higher input costs and thinner profit margins. For exporters, they raise the risk of retaliation, which can limit access to key overseas markets. Investors, anticipating these challenges, often respond by reducing exposure to equities and shifting capital toward safer instruments. This reaction was clearly visible today as major indices turned sharply lower.

Tech Sector Under Heavy Pressure

Technology stocks, which have led market rallies in recent years, are now at the center of the sell-off. High valuations, global exposure, and dependence on complex supply chains make the tech sector particularly vulnerable to trade disruptions. Semiconductor manufacturers, cloud service providers, consumer electronics firms, and e-commerce giants all rely on international production networks and cross-border sales.

As tariff uncertainty rises, concerns grow that component costs will increase, delivery timelines will be disrupted, and demand in key markets could weaken. This has triggered a broad retreat from large-cap tech shares, dragging down major indices and contributing significantly to overall market losses. The sell-off reflects not only trade fears but also a broader reassessment of growth expectations in a higher-risk environment.

Futures Point to a Weak Market Open

Equity futures, often considered a forward-looking indicator of market sentiment, have signaled further weakness. A sharp drop in futures contracts linked to major indices suggests that traders expect selling pressure to continue. Futures markets tend to react quickly to geopolitical and economic developments, making them a real-time barometer of investor mood.

The decline in futures underscores the cautious stance adopted by institutional investors, who are hedging portfolios and reducing leverage. This behavior indicates expectations of heightened volatility and potential downside in the near term, especially if trade rhetoric escalates or economic data disappoints.

Global Markets Echo the Downtrend

The impact of today’s developments is not confined to the United States. Asian and European markets have also felt the strain, with major benchmarks recording losses. Export-driven economies are particularly sensitive to tariff news, as any slowdown in global trade can quickly translate into weaker corporate earnings and lower economic growth.

In Europe, manufacturing and industrial stocks have faced pressure, while in Asia, technology and automotive shares have been among the hardest hit. The synchronized nature of the sell-off highlights the interconnectedness of modern financial markets, where policy decisions in one region can trigger reactions worldwide within minutes.

Safe-Haven Assets Attract Capital

As equities retreat, investors are turning toward traditional safe havens. Gold prices have strengthened, reflecting its role as a store of value during periods of uncertainty. Government bonds have also seen increased demand, pushing yields lower as capital flows into fixed-income securities.

This shift toward safety is a classic response to rising risk. When confidence in growth-oriented assets weakens, investors prioritize capital preservation, even if it means accepting lower returns. The movement into gold and bonds suggests that market participants are bracing for prolonged volatility rather than a short-lived correction.

The Role of Central Banks and Inflation

Another layer of complexity comes from monetary policy. Central banks around the world are navigating a delicate balance between controlling inflation and supporting economic growth. Any indication that interest rates may remain higher for longer can add pressure to equity markets, particularly to growth stocks that depend on cheap financing.

Tariffs can also be inflationary, as higher import costs are often passed on to consumers. This creates a challenging environment for policymakers, who must weigh the risk of slowing growth against the need to keep price pressures in check. Market participants are closely watching central bank statements for clues about future rate moves, as these will play a crucial role in shaping investment decisions.

Corporate Earnings in Focus

Earnings season adds another dimension to today’s market dynamics. Companies are reporting results against a backdrop of rising costs, uncertain demand, and geopolitical tension. Guidance for future quarters is under intense scrutiny, as investors seek to understand how trade policies and economic conditions might affect profitability.

Firms with diversified supply chains and strong pricing power may prove more resilient, while those heavily exposed to international trade could face margin compression. Market reactions to earnings surprises, both positive and negative, are likely to be amplified in the current volatile environment.

Investor Psychology and Market Volatility

Beyond fundamentals, psychology plays a crucial role in market movements. Fear of missing out can drive rallies, while fear of losses can accelerate sell-offs. News related to tariffs, geopolitical tensions, or economic slowdowns can quickly shift sentiment from optimism to caution.

Volatility indices, which measure expected market fluctuations, often rise during such periods, signaling increased demand for protective strategies. Options trading activity tends to surge as investors seek to hedge portfolios against sharp price swings. These indicators suggest that uncertainty is a defining feature of the current market landscape.

Long-Term Implications for Portfolio Strategy

While short-term volatility can be unsettling, it also offers valuable lessons for long-term investors. Diversification across asset classes, sectors, and regions remains a key strategy for managing risk. Exposure to defensive sectors, such as healthcare and consumer staples, can help cushion portfolios during economic slowdowns.

Maintaining a disciplined approach, focusing on fundamentals, and avoiding emotional decision-making are essential during turbulent periods. History shows that markets eventually adapt to new realities, whether they involve policy changes, technological shifts, or global economic transitions.

Is This a Temporary Setback or a Structural Shift?

A central question facing investors is whether today’s turmoil represents a temporary correction or the beginning of a more prolonged downturn. Much will depend on how trade negotiations evolve, how central banks respond to inflation and growth challenges, and how resilient corporate earnings prove to be.

If tensions ease and economic data remain supportive, markets could stabilize and resume their upward trend. However, if trade conflicts intensify and global growth slows, a longer period of consolidation or decline cannot be ruled out. The coming weeks will be critical in determining the broader trajectory.

Conclusion

“Stock Market Today” captures a moment defined by tariff shock, technology sector turbulence, and falling futures. The convergence of geopolitical uncertainty, valuation concerns, and shifting monetary expectations has created a volatile environment that demands caution and strategic thinking.

While the near-term outlook is clouded by risk, markets are inherently forward-looking and adaptive. Investors who remain informed, diversified, and focused on long-term goals are better positioned to navigate the current storm. As trade policies, economic indicators, and corporate performance continue to evolve, they will shape the next chapter in the ongoing story of global financial markets.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

About the Author

usa5911.com

Administrator

Hi, I’m Gurdeep Singh, a professional content writer from India with over 3 years of experience in the field. I specialize in covering U.S. politics, delivering timely and engaging content tailored specifically for an American audience. Along with my dedicated team, we track and report on all the latest political trends, news, and in-depth analysis shaping the United States today. Our goal is to provide clear, factual, and compelling content that keeps readers informed and engaged with the ever-changing political landscape.