Obamacare Shock: Premiums Set to Spike as Senate Stalls

The US Senate has failed to pass legislation to expand the Affordable Care Act (ACA) tax credit. Today we will discuss about Obamacare Shock: Premiums Set to Spike as Senate Stalls

Obamacare Shock: Premiums Set to Spike as Senate Stalls

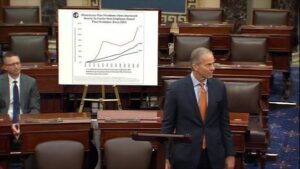

The United States is once again staring down a major healthcare crisis as millions of Americans brace for dramatic increases in their health insurance premiums. The Affordable Care Act (ACA), widely known as Obamacare, has been a central pillar of the nation’s healthcare landscape for over a decade. But with enhanced subsidies set to expire and the U.S. Senate at a complete standstill, the stability of the entire system is at risk. Consumers, insurers, policymakers, and economists are warning that an unprecedented shockwave could hit the healthcare marketplace as early as January 2026.

For years, enhanced premium tax credits have made healthcare more affordable for millions of families. These credits were introduced during the COVID-19 pandemic and later extended by Congress to cushion the economic blow to households. But those temporary measures expire soon, and with the Senate unable to find common ground on how to extend or modify them, premiums look set to surge to levels that many families simply cannot afford.

The looming crisis underscores the fragile nature of the current system and exposes the deep partisan divisions that have long plagued U.S. healthcare policy. What comes next will not only affect millions of households but could also reshape the political landscape heading into the 2026 midterm elections.

Why Premiums Are Set to Spike

The central issue driving the expected premium surge is the expiration of enhanced ACA subsidies. These subsidies dramatically lowered the cost of insurance for many Americans—sometimes reducing premiums to nearly zero for lower-income households.

The Pandemic-Era Expansion

At the height of the pandemic, soaring unemployment and financial instability threatened to push millions off their insurance plans. In response, Congress expanded the ACA’s premium tax credits to cover a much broader segment of the population. This expansion capped premiums at lower percentages of household income and eliminated the previous upper-income eligibility limits.

The impact was immediate and profound. Enrollment in ACA marketplaces climbed to record-breaking highs. Millions who previously found premiums unaffordable were suddenly able to secure coverage. Older adults and middle-income families, who often face higher premiums due to age-based pricing, saw some of the greatest benefits.

The Return of the “Subsidy Cliff”

Without further congressional action, the enhanced subsidies will expire at the end of December 2025. When that happens, the old rules return—including the notorious “subsidy cliff,” where individuals earning just above the eligibility threshold suddenly face full market-rate premiums.

For a 60-year-old individual living in a rural area, that could mean going from a subsidized premium of around $200 a month to more than $1,000 a month overnight. For families, the jump could be even higher. Analysts predict that millions may be forced to drop their coverage entirely or switch to lower-quality plans with higher deductibles.

The Senate Stalemate: How Congress Failed to Act

Congress had multiple opportunities to avert the crisis. Yet despite heated debate and several proposals, the Senate ended its session without passing any plan to extend the subsidies or replace them with an alternative.

The Competing Proposals

Two main proposals were brought forward:

The Democratic Plan: This bill sought a three-year extension of the enhanced subsidies. Supporters argued that extending the credits would stabilize markets, protect families, and prevent steep increases in premiums. The proposal received some bipartisan interest but fell short of the 60 votes needed to overcome procedural hurdles.

The Republican Plan: This alternative sought to shift support toward health savings accounts (HSAs), offering families more flexibility and market-driven choices. However, the plan did not include direct premium assistance, making it unpopular among moderates and insufficient to prevent premium hikes in the short term.

Both bills failed, leaving Congress heading into recess with no deal in place. The Senate’s inability to break through partisan gridlock means the subsidies will expire by default.

Why the Deadlock Matters

This deadlock is not merely symbolic—it creates real and immediate consequences. Insurance companies must finalize their 2026 premium rates months in advance. Without clarity from Congress, insurers have assumed that subsidies will end, forcing them to set premiums much higher to compensate for anticipated loss of customers and market instability.

What Consumers Can Expect in 2026

Massive Premium Increases

Analysts forecast that premiums for many ACA plans could double or even triple once subsidies expire. Exact increases vary by state and income level, but the trend remains consistent: virtually everyone will pay more.

Some projections indicate:

Average annual premiums may jump from under $900 for subsidized enrollees to nearly $2,000 or more.

Middle-income families not eligible for traditional subsidies could face increases exceeding 300%.

Older Americans, who already pay higher base premiums, could see the largest spikes of all.

Consumers in rural states or those with fewer insurance providers are particularly vulnerable, as lack of competition already inflates costs.

A Rise in Uninsured Americans

When premiums increase, enrollment tends to fall. Economists warn that the nation could see one of the biggest increases in the uninsured rate since the ACA launched in 2010. Younger, healthier individuals are usually the first to drop coverage, which then leaves insurers with a more expensive risk pool—forcing premiums even higher in a vicious cycle known as the death spiral.

Millions who leave the market will instead rely on emergency rooms, charity care, or go without care entirely, worsening both public health outcomes and healthcare system strain.

Impact on Insurers and the Healthcare Industry

Market Instability Ahead

Insurance companies have urged Congress to act for months. Their argument is simple: subsidies stabilize the market by ensuring steady enrollment. Without them, insurers anticipate:

Larger numbers of consumers exiting the ACA marketplaces

Higher average medical costs per enrollee

The possibility of some insurers withdrawing from the exchanges altogether

Hospitals and healthcare networks also expect rising costs. When uninsured rates climb, uncompensated care increases. This can raise healthcare prices broadly, affecting not just individuals on the ACA but people on employer plans and Medicare as well.

Pressure on State Governments

Some states with their own health insurance marketplaces may attempt temporary fixes, such as state-funded subsidies or reinsurance programs. However, few states have the budget capacity to replace billions in lost federal funding. Compounding the crisis, several states are already grappling with budget shortfalls and other healthcare-related obligations.

The Political Fallout

A High-Stakes Battle Heading Into 2026

With midterm elections only months away, both parties now face significant political risks.

Democrats blame Republicans for blocking the subsidy extension and argue that the GOP is intentionally jeopardizing healthcare affordability.

Republicans counter that the temporary subsidies were never designed to be permanent and insist that long-term reforms—not short-term patches—are the only sustainable path forward.

Voters, however, are generally supportive of maintaining the subsidies, with polling showing broad bipartisan public backing. If premiums spike as predicted, this issue could become one of the top voter concerns in the 2026 election cycle.

A Repeat of Past Healthcare Battles

Healthcare has long been a defining political battleground. The fight over subsidy extensions echoes earlier legislative conflicts, including attempts to repeal the ACA entirely and disputes over Medicaid expansion. Both parties see enormous political opportunity in shaping the narrative over who is responsible for rising costs.

Possible Solutions: What Comes Next?

Although the Senate failed to act, the story isn’t over. Pressure is now shifting to the House of Representatives, where several bipartisan groups are exploring potential compromises.

Paths Lawmakers Might Pursue

Short-Term Extension:

A simple extension of enhanced subsidies for one or two years to buy lawmakers more time.Targeted Subsidy Reform:

Adjusting the income thresholds or focusing support on middle-income households that face the steepest increases.Broader Healthcare Overhaul:

Some lawmakers argue for structural reforms to address long-term affordability rather than renewing temporary measures.State-Federal Partnerships:

A shared funding model where states contribute partial subsidies, easing the federal burden.

However, any proposal will still require bipartisan support in the Senate, meaning the same challenges remain.

Conclusion: An Avoidable Crisis Still Unfolding

The impending surge in Obamacare premiums is a crisis that many experts argue could have been prevented with timely congressional action. Instead, political divisions and legislative gridlock have left millions of Americans facing a future of uncertainty and sharply rising healthcare costs.

In the coming months, families will make difficult choices about whether to keep their insurance, downgrade their plans, or drop coverage entirely. Insurers will brace for market volatility. Hospitals will prepare for higher rates of uncompensated care. And lawmakers will confront a deeply frustrated electorate.

Whether Congress returns in time to enact a fix remains uncertain. But one thing is clear: the upcoming “Obamacare shock” will not merely be a policy failure—it will be a defining moment in America’s ongoing struggle to deliver affordable, accessible healthcare to all its citizens.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

About the Author

usa5911.com

Administrator

Hi, I’m Gurdeep Singh, a professional content writer from India with over 3 years of experience in the field. I specialize in covering U.S. politics, delivering timely and engaging content tailored specifically for an American audience. Along with my dedicated team, we track and report on all the latest political trends, news, and in-depth analysis shaping the United States today. Our goal is to provide clear, factual, and compelling content that keeps readers informed and engaged with the ever-changing political landscape.