UK Government : Budget Surplus Boost, Economic Shift, Tax Pressure Debate

In a striking shift from chronic deficits that have defined British public finances for decades, the UK government recorded a historic budget surplus in January 2026, registering £30.4 billion — the largest since monthly records began in 1993. This unexpected fiscal performance has catalysed discussions across political, economic, and investment communities, touching on government spending priorities, tax policy direction, and the sustainability of the UK’s economic recovery.

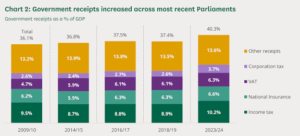

The surge in surplus is largely attributed to stronger-than-projected tax revenues — particularly from self-assessment and capital gains taxes — alongside reduced borrowing costs, which together outweighed government spending for the month.

In this comprehensive guide we explore how this surplus came about, what it means for the UK economy, the ongoing debate over tax pressures, and what lies ahead for fiscal policy.

What Is a Budget Surplus? (And Why It Matters)

A budget surplus occurs when a government’s revenues — chiefly taxes — exceed its expenditures over a specified period. In contrast, a budget deficit exists when expenditures outstrip revenues, requiring additional borrowing to fill the gap.

For most of the last 50 years, the UK’s public finances have run at a deficit. Surpluses have been the exception rather than the norm — only occurring in a handful of years since the late 20th century.

The January 2026 surplus is therefore notable not just for its magnitude but for what it signals about the UK’s fiscal trajectory in a post-pandemic and post-Brexit economic landscape.

Key Factors Driving the 2026 Surplus

1. Record Tax Revenues

A powerful driver of the surplus was soaring tax receipts, especially from:

Self-assessed income taxes — typically collected in large lump sums in January.

Capital Gains Tax (CGT) — which saw a significant uptick as individuals disposed of assets ahead of expected CGT rate increases.

Combined receipts from income and capital gains taxes reached record levels, far outpacing forecasts from independent fiscal watchdogs.

2. Lower Debt Interest Payments

An easing of inflation and reduced government borrowing costs helped lower the amount the UK pays to service its debt, freeing up public finances further.

3. Economic Activity Improvements

Stronger retail sales and expanded private sector activity complemented the fiscal picture, providing wider signs of momentum in parts of the economy.

Economic Implications of the Budget Surplus

Positive Signals for Fiscal Stability

The surprise surplus provides political and economic capital for the government, reinforcing narratives of:

Improved fiscal discipline

Reduced reliance on borrowing

Potential buffer against future economic shocks

In official projections, total borrowing for the current fiscal year remains lower than previous forecasts, even though a full annual surplus is not yet assured.

Pressure on Monetary Policy

Economists have noted that, despite the surplus, room for interest rate cuts or tax reductions may remain constrained — particularly given lingering inflationary pressures and public debt levels.

Long-Term Deficit Outlook

Independent forecasts still expect total UK borrowing to remain in deficit for the 2025-26 financial year, albeit significantly reduced from prior projections.

The Tax Pressure Debate

The existence of a surplus has ignited an intense debate over tax policy and public spending. Key points of contention include:

✔ Should Surpluses Lead to Tax Cuts?

Some economists and political figures argue that a surplus justifies tax relief for households and businesses — especially given cost pressures tied to inflation and living costs. Critics, however, counter that long-term structural deficits remain a risk and that selective tax reductions could undermine fiscal sustainability.

✔ Has the Government Raised Taxes Too Far?

The current government has enacted substantial tax increases over the past two years to shore up finances, including freezing income tax thresholds — a move sometimes described as a stealth tax that pulls more people into higher tax brackets as wages rise with inflation.

These measures are criticised by some as acting as a headwind against growth, potentially deterring investment and dampening living standards over time.

✔ Do Tax Increases Impact the Broader Economy?

Raising taxes — particularly on employers (e.g., national insurance contributions) — has been linked to slower hiring, reduced wage growth, and increased inflationary pressures according to business groups and analysts.

✔ Where Should the Surplus Be Used Instead?

Alternatives to tax cuts include:

Investing in public services (education, healthcare, infrastructure)

Reducing public debt levels

Targeted relief for low- and middle-income households

Each option has supporters and detractors, reflecting broader ideological divides over the role of the state and economic strategy.

Political Implications

The surplus figure has powerful political ramifications. Opposition parties use surplus data to critique government tax policies, arguing they have compressed economic growth and squeezed voters unnecessarily. Conversely, the ruling party frames the surplus as vindication of fiscal prudence.

Election considerations are shaping how both sides deploy surplus figures — especially as public opinion remains divided on tax burdens versus service delivery and debt priorities.

What Experts Say

Fiscal think-tanks and independent analysts have weighed in with varied perspectives:

The Institute for Fiscal Studies (IFS) argues that fiscal rules are increasingly outdated and suggests a broader traffic-light indicator system to assess financial health transparently rather than focusing narrowly on budget headroom.

Critics warn that overly tight fiscal rules could stifle investment in growth-enhancing areas or social support frameworks.

Despite record monthly surpluses, many experts urge caution, highlighting that one strong month does not guarantee a fully balanced budget over a year.

Looking Ahead: Risks and Opportunities

Risks

Sluggish Economic Growth: Even with strong tax receipts, underlying GDP growth remains modest.

High Public Debt: Debt levels as a share of GDP are historically high, complicating future fiscal choices.

Political Volatility: Shifting tax and spending policies could undermine investor confidence.

Opportunities

Fiscal Headroom: Surpluses open room for strategic investments or targeted fiscal stimulus.

Lower Interest Costs: Reduced borrowing costs could create space for mixed policies combining investment and relief.

Rebalancing Policies: The government may leverage surplus data to justify structural reforms or economic diversification.

FAQs About the UK Budget Surplus and Tax Debate

1. What exactly is a budget surplus?

A budget surplus occurs when a government’s tax revenues and other income exceed its total spending over a period.

2. Why does the UK rarely run a surplus?

Due to large government outlays, economic shocks (like the pandemic), and structural spending pressures, the UK has historically spent more than it collected in most years. Surpluses are rare and often tied to unique annual tax timing patterns.

3. Does a monthly surplus mean the UK now has a balanced budget for the year?

Not necessarily. A monthly surplus indicates strong performance in that period, but the year-end fiscal balance depends on total revenues and expenditures across all months.

4. How do tax increases contribute to surpluses?

Higher tax receipts — whether through rate increases, threshold freezes, or broader bases — directly increase revenue, which can boost surpluses if spending growth is contained.

5. Will the surplus lead to tax cuts?

It’s possible, but government statements suggest caution. Some policymakers argue that structural economic issues should be addressed before rolling back taxes universally.

Conclusion

The UK’s record budget surplus marks a turning point in public finance debate, blending economic data with political narratives around taxation, growth, and fiscal stewardship. Whether this surplus heralds a new era of balanced budgets, tax relief, or strategic investment remains subject to ongoing policy decisions and economic conditions.

For policymakers, economists, and the public alike, this represents both a challenge and an opportunity — balancing immediate fiscal gains with long-term economic resilience and societal welfare.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

About the Author

usa5911.com

Administrator

Hi, I’m Gurdeep Singh, a professional content writer from India with over 3 years of experience in the field. I specialize in covering U.S. politics, delivering timely and engaging content tailored specifically for an American audience. Along with my dedicated team, we track and report on all the latest political trends, news, and in-depth analysis shaping the United States today. Our goal is to provide clear, factual, and compelling content that keeps readers informed and engaged with the ever-changing political landscape.