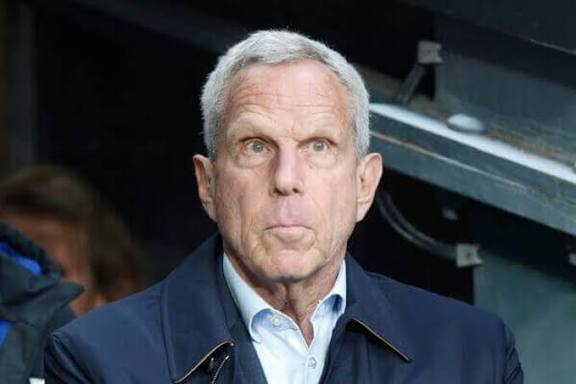

Jerome Powell : Fed term ending, rate shock, market turmoil, US economy alert

The nomination came as Trump pressured Powell to cut interest rates; Warsh faces a challenging Senate confirmation. Today we will discuss about Jerome Powell : Fed term ending, rate shock, market turmoil, US economy alert

Jerome Powell : Fed term ending, rate shock, market turmoil, US economy alert

Jerome Powell stands at a historic crossroads as his term as Chair of the US Federal Reserve approaches its end. With global markets hanging on every word from the central bank, Powell’s final phase in office is unfolding amid heightened concerns over interest rates, market volatility, and the long-term health of the US economy. Investors, policymakers, and economists are all grappling with one pressing question: what comes next after Powell?

His leadership has coincided with one of the most turbulent economic eras in modern US history. Inflation shocks, aggressive rate hikes, post-pandemic recovery struggles, and growing political pressure have all shaped his tenure. As the clock ticks down on his term, the consequences of his decisions are becoming clearer—and more controversial.

Jerome Powell’s Journey to the Top of the Fed

Jerome Powell assumed the role of Federal Reserve Chair in 2018, inheriting an economy still shaped by the long shadow of the global financial crisis. Unlike many of his predecessors, Powell did not come from a traditional academic economics background. Instead, his career blended law, finance, and public service—a background that would later influence his pragmatic, data-driven approach to monetary policy.

During his leadership, the Federal Reserve faced unprecedented challenges. From emergency stimulus measures during global shocks to the fastest interest-rate tightening cycle in decades, Powell’s Fed became synonymous with decisive, sometimes painful, policy action.

The End of Powell’s Fed Term: Why It Matters

Powell’s term is scheduled to end in May 2026, marking a critical transition for US monetary policy. Leadership changes at the Federal Reserve are always significant, but the timing of Powell’s exit makes this moment particularly sensitive.

The US economy is not in crisis, yet it is far from stable. Inflation has cooled from its peak but remains stubbornly above target. Economic growth is slowing, while consumer confidence and business investment show mixed signals. Markets fear that any abrupt shift in leadership philosophy could trigger instability.

Powell’s final months are therefore not just about maintaining policy continuity—they are about shaping expectations for the next era of the Fed.

Interest Rates and the Shock Factor

From Aggressive Hikes to a Cautious Pause

One of the defining features of Jerome Powell’s tenure has been the Federal Reserve’s dramatic interest-rate cycle. After keeping rates near historic lows, the Fed embarked on an aggressive tightening campaign to combat surging inflation. This strategy sent borrowing costs soaring and fundamentally reshaped financial markets.

By late 2025, the Fed shifted gears. After a series of rate cuts intended to ease pressure on households and businesses, Powell opted for a pause. This decision surprised some investors who expected a faster return to low-rate conditions.

The result was a phenomenon often described as a “rate shock”—not from sudden hikes, but from the realization that rates may remain higher for longer than markets had hoped.

Why Powell Refuses to Rush

Powell has consistently emphasized that monetary policy is not on autopilot. He has warned that cutting rates too quickly could reignite inflation, undoing years of hard-won progress. This cautious stance has frustrated investors but reassured inflation hawks.

His message is clear: economic stability matters more than short-term market gains.

Market Turmoil and Investor Anxiety

Markets on Edge

Financial markets have reacted sharply to Powell’s signals. Equity markets have experienced heightened volatility, while bond yields have fluctuated as investors reassess the future path of interest rates. Currency markets, too, have responded to shifting expectations about US monetary policy.

This turbulence reflects uncertainty rather than panic. Markets are struggling to price in a future where rates remain restrictive even as growth slows—a scenario that challenges traditional investment assumptions.

The Psychological Impact of Powell’s Words

Few central bankers have wielded as much influence over markets as Jerome Powell. A single phrase in a press conference has been enough to move trillions of dollars in global assets. As his term nears its end, that influence has only intensified.

Investors are increasingly sensitive to any hint about succession, policy continuity, or shifts in the Fed’s long-term strategy.

The US Economy: Warning Lights and Resilience

Inflation Still a Threat

Despite progress, inflation remains above the Federal Reserve’s long-term target. Price pressures in housing, services, and energy continue to challenge policymakers. Powell has warned that inflation risks have not disappeared—and that complacency could prove costly.

Labor Market Signals

The US labor market has cooled from its post-pandemic highs. Hiring has slowed, wage growth has moderated, and concerns about rising unemployment are growing. While the job market remains relatively strong, cracks are beginning to show.

Powell has acknowledged these risks, stressing that the Fed must balance its inflation mandate with its responsibility to support employment.

Growth Under Pressure

Consumer spending, a key driver of the US economy, has shown signs of strain as higher interest rates bite. Businesses face higher financing costs, leading to cautious investment decisions. At the same time, geopolitical tensions and trade disruptions add another layer of uncertainty.

Political Pressure and Fed Independence

An Uncomfortable Spotlight

Jerome Powell’s final stretch has been marked by growing political scrutiny. Public criticism of the Federal Reserve has intensified, with calls for looser policy coming from multiple corners of the political spectrum.

Powell has repeatedly defended the Fed’s independence, arguing that political interference in monetary policy would undermine long-term economic stability.

Succession Speculation and Its Impact

Speculation about Powell’s successor has become a market issue in its own right. Any perception that the next Fed chair might favor political priorities over data-driven decision-making has raised concerns among investors.

The uncertainty surrounding leadership transition has added to market volatility, reinforcing the importance of Powell’s steady hand during his remaining time in office.

Powell’s Communication Strategy

One of Powell’s most notable contributions has been his emphasis on clear, transparent communication. Rather than relying on cryptic signals, he has sought to explain the Fed’s reasoning in plain language.

This approach has helped anchor expectations, even when markets disagree with the Fed’s direction. Powell’s insistence on “data dependence” has become a defining feature of his leadership.

What Will Jerome Powell’s Legacy Be?

1. The Inflation Fighter

Powell will likely be remembered as the chair who confronted the most severe inflation surge in decades. His willingness to raise rates aggressively, despite political backlash, reshaped the economic landscape.

2. The Guardian of Independence

At a time of rising polarization, Powell’s defense of Federal Reserve independence may stand as one of his most enduring achievements.

3. The Steady Communicator

Powell’s calm, methodical communication style helped guide markets through uncertainty, even when his message was unwelcome.

What Comes Next for the Fed and the Economy

As Powell prepares to step down, the Federal Reserve faces a delicate balancing act. The next chair will inherit an economy still adjusting to higher rates, lingering inflation risks, and fragile global conditions.

Markets will closely watch how Powell concludes his term—whether he opts for further caution, signals a shift, or focuses entirely on maintaining stability during the transition.

Conclusion: An Economy on Alert, a Chair Under Watch

Jerome Powell’s final chapter as Fed chair is unfolding under intense scrutiny. With interest rates, markets, and the US economy all in a state of cautious tension, his decisions carry enormous weight.

Whether history judges Powell as overly cautious or wisely restrained will depend on how the economy performs in the years ahead. What is clear is that his leadership has left an indelible mark on US monetary policy—and the reverberations will be felt long after his term ends.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

About the Author

usa5911.com

Administrator

Hi, I’m Gurdeep Singh, a professional content writer from India with over 3 years of experience in the field. I specialize in covering U.S. politics, delivering timely and engaging content tailored specifically for an American audience. Along with my dedicated team, we track and report on all the latest political trends, news, and in-depth analysis shaping the United States today. Our goal is to provide clear, factual, and compelling content that keeps readers informed and engaged with the ever-changing political landscape.