Kevin Warsh : Fed power play, Trump economy circle, Wall Street influence, rate policy

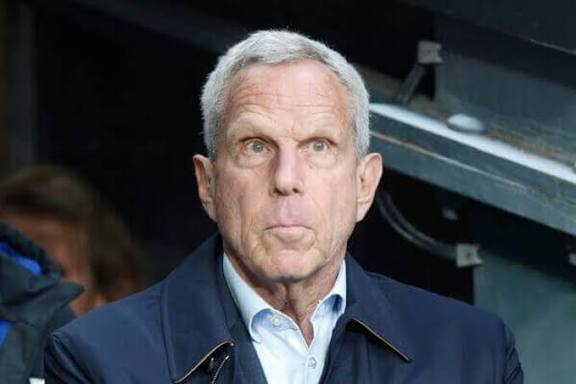

Warsh, 55, is a former Federal Reserve governor and has deep ties to Wall Street and the policymaking circles of Washington. Today we will discuss about Kevin Warsh : Fed power play, Trump economy circle, Wall Street influence, rate policy

Kevin Warsh : Fed power play, Trump economy circle, Wall Street influence, rate policy

The nomination of Kevin Warsh to a leading role in U.S. monetary policy has reignited intense debate over the future of the Federal Reserve, the balance between political influence and central bank independence, and the direction of interest-rate policy in a fragile global economy. A former Federal Reserve governor, Wall Street veteran, and influential economic thinker, Warsh stands at the intersection of finance, politics, and power.

As President Donald Trump reshapes his economic inner circle, Kevin Warsh has emerged as a central figure—seen by supporters as a reformer capable of restoring discipline to the Fed, and by critics as a symbol of Wall Street’s enduring influence over public institutions. This article explores Warsh’s background, his role within the Trump economic orbit, his views on inflation and interest rates, and what his rise could mean for the U.S. and global economy.

Who Is Kevin Warsh?

Kevin Maxwell Warsh was born in 1970 in Albany, New York, into a family deeply connected to public life and business. From an early age, Warsh demonstrated a keen interest in policy and governance, a path reinforced by his academic journey. He earned a degree in public policy from Stanford University before going on to receive a law degree from Harvard Law School.

Unlike many economists who rise through academic ranks, Warsh’s formative professional years were spent on Wall Street. At Morgan Stanley, he worked in mergers and acquisitions and corporate finance, gaining firsthand exposure to financial markets, risk management, and the inner workings of major investment institutions. This experience would later define his reputation as a Fed official deeply attuned to market dynamics.

Warsh transitioned into government service in the early 2000s, serving as a senior economic adviser in the White House before being appointed to the Federal Reserve Board of Governors in 2006, at just 35 years old—one of the youngest Fed governors in history.

Warsh at the Federal Reserve: Crisis and Controversy

Kevin Warsh’s tenure at the Federal Reserve coincided with one of the most turbulent periods in modern financial history. When the 2008 global financial crisis erupted, Warsh became one of the Fed’s most visible figures, acting as a crucial liaison between the central bank and Wall Street institutions.

During this period, he was deeply involved in crisis communications, emergency liquidity programs, and high-stakes negotiations aimed at preventing systemic collapse. Insiders often described him as calm under pressure, highly analytical, and unusually comfortable engaging with financial executives during moments of extreme uncertainty.

However, Warsh was never fully aligned with the Fed’s most aggressive crisis-era policies. While he supported emergency action to stabilize markets, he consistently expressed concern about the long-term consequences of ultra-low interest rates and quantitative easing. He warned that excessive monetary stimulus could distort asset prices, encourage reckless risk-taking, and eventually fuel inflation.

These views placed him at odds with more dovish policymakers and cemented his reputation as an inflation hawk—a label that continues to shape perceptions of him today.

Wall Street Influence: Asset or Liability?

Few figures embody the revolving door between Wall Street and Washington as clearly as Kevin Warsh. His critics argue that his background makes him overly sympathetic to financial institutions, potentially prioritizing market stability over labor markets or income inequality.

Supporters counter that Warsh’s Wall Street experience is precisely what makes him effective. They argue that understanding how markets actually function—rather than relying solely on theoretical models—is essential for sound monetary policy. From this perspective, Warsh’s ability to anticipate market reactions is a strength, not a weakness.

Throughout his career, Warsh has maintained close relationships with investors, bankers, and economic elites. These connections place him firmly within the Wall Street influence network, but they also give him insight into capital flows, investor psychology, and systemic risk.

The central question is whether this proximity enhances policy realism or undermines public trust in the Federal Reserve as an independent institution.

Kevin Warsh and the Trump Economy Circle

Kevin Warsh’s reemergence in national prominence is inseparable from his relationship with Donald Trump’s economic circle. Trump has long been critical of the Federal Reserve, particularly its reluctance to cut interest rates aggressively during periods of political pressure.

Warsh’s skepticism of prolonged monetary expansion, combined with his evolving views on growth-oriented rate policy, makes him an appealing figure within Trump’s orbit. Unlike some central bankers who emphasize institutional independence above all else, Warsh has openly questioned whether the Fed’s current structure and communication strategy serve the broader economy.

Trump’s economic philosophy favors lower rates, weaker currency pressure, and aggressive growth policies. Warsh, while not an unconditional supporter of these goals, has shown flexibility—acknowledging that strategic rate cuts can support economic momentum without necessarily triggering inflation.

This alignment has fueled speculation that Warsh represents a bridge between political power and monetary authority, raising both hopes of reform and fears of politicization.

Monetary Policy Philosophy: Hawk With Nuance

Kevin Warsh’s views on interest rates and inflation are more complex than his “hawk” label suggests. While he has consistently warned about the dangers of excessive liquidity and long-term inflation risk, he has also demonstrated willingness to adapt to changing economic conditions.

In recent years, Warsh has acknowledged that traditional inflation models have struggled to explain real-world outcomes. Despite unprecedented stimulus, inflation remained subdued for long periods—prompting him to reconsider rigid assumptions.

Warsh has argued that productivity growth, particularly driven by technology and artificial intelligence, may allow economies to grow faster without triggering inflation. This perspective suggests that monetary policy should be more flexible, data-driven, and responsive to structural change.

Still, he remains deeply concerned about the Fed’s balance sheet expansion and what he sees as mission creep into areas beyond core monetary policy.

Criticism of the Modern Federal Reserve

One of Warsh’s most controversial positions is his call for structural reform at the Federal Reserve. He has argued that the Fed has become too opaque, too reactive, and too entangled in fiscal policy.

Warsh has proposed revisiting the foundational relationship between the U.S. Treasury and the Federal Reserve, suggesting a modernized framework that clarifies responsibilities around debt issuance, balance-sheet management, and crisis response.

To supporters, this represents overdue reform that could restore credibility and predictability. To critics, it risks weakening the Fed’s independence and opening the door to political interference.

This debate strikes at the heart of modern central banking: how to remain independent while operating in an increasingly politicized economic environment.

Market Reaction and Investor Sentiment

Financial markets closely monitor Kevin Warsh’s influence because his views directly affect expectations around interest-rate policy. Any signal that the Fed may adopt a more growth-friendly stance tends to boost equities while pressuring bonds and safe-haven assets.

At the same time, concerns about inflation and tighter long-term policy can strengthen the dollar and weigh on risk-sensitive markets. Warsh’s mixed signals—hawkish in principle, flexible in practice—have introduced a degree of uncertainty that markets are still pricing in.

Investors view him as intellectually serious, market-savvy, and willing to challenge consensus—traits that can either stabilize expectations or amplify volatility, depending on execution.

Political and Senate Challenges

Any elevation of Kevin Warsh to a top Fed role would require navigating a deeply divided political landscape. Lawmakers skeptical of Wall Street influence are likely to question his independence, while others will probe his relationship with Trump and the White House.

Supporters will emphasize his crisis experience, intellectual rigor, and willingness to confront uncomfortable policy truths. Opponents will focus on concerns about politicization, inequality, and financial favoritism.

The confirmation process itself may become a proxy battle over the future of the Federal Reserve.

What Kevin Warsh Represents

Kevin Warsh is more than a potential Fed power broker—he represents a broader philosophical shift in how monetary policy is debated in the United States.

He embodies:

Skepticism of unlimited stimulus

Willingness to challenge institutional norms

Comfort operating between markets and government

Openness to reforming central banking structures

Whether this makes him the right leader depends on one’s view of the Fed’s current trajectory.

Conclusion: A Defining Figure in a New Economic Era

Kevin Warsh’s rise reflects a moment of reckoning for global monetary policy. As inflation risks, geopolitical instability, and technological disruption reshape economies, traditional models are under strain.

Warsh offers a blend of Wall Street realism, crisis-era experience, and reformist ambition. To some, he is a corrective force against excess and complacency. To others, he is a reminder of how deeply finance and power remain intertwined.

What is undeniable is that Kevin Warsh stands at the center of one of the most consequential debates in modern economics: who controls money, how it is managed, and whose interests it ultimately serves.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

About the Author

usa5911.com

Administrator

Hi, I’m Gurdeep Singh, a professional content writer from India with over 3 years of experience in the field. I specialize in covering U.S. politics, delivering timely and engaging content tailored specifically for an American audience. Along with my dedicated team, we track and report on all the latest political trends, news, and in-depth analysis shaping the United States today. Our goal is to provide clear, factual, and compelling content that keeps readers informed and engaged with the ever-changing political landscape.