Dow Jones : Market Crash, Trump Tariffs Panic, Stocks Tumult

US stock market futures fell nearly 1% after President Donald Trump announced new tariffs on imports from 92 countries. Today we will discuss about Dow Jones : Market Crash, Trump Tariffs Panic, Stocks Tumult

Dow Jones : Market Crash, Trump Tariffs Panic, Stocks Tumult

The Dow Jones Industrial Average (DJIA) — one of the world’s most closely watched stock indexes — has always been a barometer for global financial health. Yet in recent years, it has also become a symbol of how political decision-making and geopolitical tensions can dramatically destabilize markets. The crash episodes linked to Donald Trump’s tariff policies in 2025–2026 sparked intense investor panic, unprecedented volatility, and a global stock market tumult not witnessed since the COVID-19 pandemic era. This article explores the unfolding drama, its causes, mechanics, and implications for investors and the global economy.

Understanding the Dow Jones Industrial Average

Before diving into the crash and tariff panic, it’s essential to understand what the Dow Jones Industrial Average represents. The Dow Jones is a price-weighted index of 30 major U.S. companies spanning industries such as technology, finance, retail, and manufacturing. It measures the performance of some of America’s largest and most established corporations and is often used as a proxy for broader market movements.

Unlike cap-weighted indexes such as the S&P 500, the Dow’s movements are heavily influenced by higher-priced stocks regardless of the company’s market size. This makes it a unique indicator of how investor psychology — especially during crises — can impact markets.

The Prelude: Rising Trade Tensions and Tariff Rhetoric

The seeds of the 2025–2026 market turmoil were sown when President Donald Trump unveiled aggressive new tariff policies hitting major U.S. trading partners — including Canada, Mexico, China, and European Union nations — with sweeping duties on imported goods. These trade measures were introduced under the banner of reducing trade deficits and protecting American manufacturing, but markets saw them as precursors to a full-blown trade war.

On March 4, 2025, the U.S. stock market reacted to the initial shock of these tariffs. The Dow Jones Industrial Average plunged about 800 points, alongside declines in the S&P 500 and Nasdaq as investor confidence waned amid fears of hurting global economic growth.

This initial tumble was a warning shot — but what followed was far more severe.

April 2025: The Crash That Shook Wall Street

Historic Drops and Volatility

In early April 2025, markets erupted in one of the steepest sell-offs since 2020. On April 2, the Dow lost over 1,300 points as the tariffs began to crash through investor psychology, signaling fear of inflationary pressures, supply chain disruptions, and a slowdown in corporate earnings.

On April 3, the Dow plunged 1,679 points — nearly a 4% drop — marking one of its worst sessions in years. Global panic spread, wiping out trillions of dollars in market value across U.S. and international stocks.

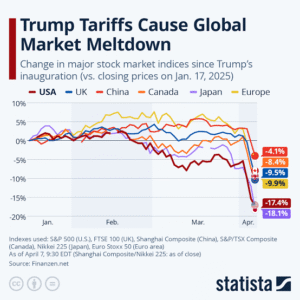

Then on April 4, the Dow nosedived even further, shedding more than 2,200 points as markets reacted to retaliation measures, including China’s 34% tariffs on U.S. imports. Over the course of two days, the Dow Jones fell roughly 9.5%, while the S&P 500 and Nasdaq plunged even more, entering correction and bear market territory, respectively.

By many metrics, this was the largest two-day point drop in Dow history, and it marked the most significant market stress event since the initial crash amid the COVID-19 pandemic. Over $6–9 trillion in global stock market value was erased in just a few trading sessions.

Sectoral Impact: Who Got Hit Hardest?

Not all stocks fell equally. Certain sectors bore the brunt of the sell-off:

Technology – Major tech companies, such as Apple and Nvidia, saw substantial losses due to concerns over supply chain disruptions and potential tariff-related cost increases. Meta, Amazon, and similar firms also faced steep sell-offs.

Retail & Consumer Goods – Companies that rely on global imports, such as Nike, Walmart, and Costco, struggled as tariff-induced cost increases threatened profit margins.

Financials & Banks – Banks and financials faced pressure as recession fears heightened, potentially reducing credit demand and increasing risk in lending portfolios.

Commodities – Even traditionally “safe haven” assets like gold and bonds experienced unusual movements as markets tried to price in inflation and risk.

Investors scrambled for safer assets, with government bonds initially rallying and gold spiking as uncertainty peaked.

The Psychology of a Crash: Fear, Panic, and Behavioral Markets

It’s a basic truism in financial markets: panic feeds panic. When a major index like the Dow starts falling dramatically, algorithms react, stop-loss orders trigger, and human traders begin selling to cut losses. Combined, these forces can amplify volatility.

The 2025 crash was a textbook example of this feedback loop:

Tariff announcements reduced investor appetite for risk, especially in globally exposed sectors.

Initial sell-offs triggered technical triggers such as margin calls and stop-losses, causing accelerated selling.

Media coverage of historic drops fed fear among retail investors, amplifying the downward spiral.

Global contagion meant markets worldwide joined in the sell-off — Tokyo’s Nikkei fell over 7%, and European indices tumbled in sympathy.

These psychological triggers, combined with fundamental economic concerns, created a self-reinforcing cycle.

Global Contagion and Cross-Market Turmoil

The Dow’s crash did not stay confined to U.S. borders.

When major U.S. markets fall, global equity markets often follow. The sell-off quickly spread to Asia, Europe, and emerging markets:

Asian markets saw steep declines, with key indexes such as the Nikkei and Kospi dropping sharply amid tariff panic.

European indices such as the FTSE 100 and DAX sold off as investors priced in the potential of tit-for-tat tariffs and slower global demand.

Currency markets reflected risk aversion as the U.S. dollar weakened and safe-haven currencies like the Swiss franc strengthened, showing that stock market fears spilled into forex markets as well.

This global ripple effect underscored how interconnected modern financial markets have become — any systemic shock in the U.S. often resonates worldwide.

Tariffs, Trade Wars, and Market Uncertainty

What Tariffs Meant for Markets

Tariffs raise the cost of imported goods, which can, in turn, increase production costs for companies that rely on global supply chains. If tariffs are sudden or broad, companies struggle to adjust pricing and logistics quickly — and investors tend to sell first and ask questions later.

The April 2025 tariff blast announced by the U.S. government included baseline duties on imports from key trading partners and additional targeted taxes on China, the EU, and more. This aggressive strategy was interpreted by many economists and traders not only as an inflationary risk but as a threat to global economic growth.

As markets digested these policy changes, several consequences emerged:

Higher input costs for manufacturers and retailers

Inflation pressure, potentially offsetting favorable actions by the Federal Reserve

Reduced global trade volumes

Retaliatory tariffs from trade partners

This cocktail of risks was enough to flip investor sentiment from cautious optimism to full-blown fear.

Resilience and Recovery: What Happened Next?

Central Banks and Policy Responses

In the midst of panic, central banks such as the Federal Reserve faced a dilemma: should they cut interest rates to support markets, or keep policy steady to fight inflation exacerbated by tariffs?

During the initial crash, the Federal Reserve’s hesitancy to immediately slash rates reflected concerns that lowering borrowing costs could further fuel inflation — already sensitive due to tariff-related cost pressures. This stance, in turn, maintained volatility in equity markets, prolonging uncertainty.

Meanwhile, international central banks, from the European Central Bank to the Bank of Japan, monitored global market stress for signs they needed to intervene.

Investor Strategies Amid Turmoil

Market downturns can be disastrous, but they also present opportunities for those who understand risk and timing:

Diversification became crucial as investors balanced positions across asset classes rather than solely in equities.

Safe-haven assets, including gold and some government bonds, saw inflows as traders sought protection from stock volatility.

Long-term investors who maintained a buy-and-hold philosophy often avoided locking in losses during short-term panics.

While not all portfolios escaped unscathed, history has shown that entering markets during periods of fear can, for patient investors, yield long-term gains.

Lessons from the Dow Crash Era

1. Macro Events Can Trump Fundamentals

Economic fundamentals — earnings, growth, and productivity — are vital. But during intense geopolitical events, policy shifts like tariffs can overshadow them, causing short-term dislocations that seem disconnected from underlying corporate performance.

2. Markets Reflect Psychology as Much as Economics

Fear, sentiment, and uncertainty are integral drivers of market behavior. When fear reaches a tipping point, even healthy markets can experience disproportionate declines.

3. Global Integration Elevates Systemic Risk

The financial tie-ins between economies mean shocks rarely stay isolated. A plunge in the Dow Jones tends to affect markets in Asia, Europe, and beyond.

Conclusion: The Dow’s New Normal?

The Dow Jones crash episodes tied to Trump’s tariff policies revealed a stark truth about 21st-century markets: they are deeply sensitive not just to traditional economic data, but also to political strategy and global diplomatic tensions. These connections will likely persist, and investors should be prepared for volatility born not only of economic cycles but of geopolitical shifts as well.

The events of 2025–2026 will be studied by economists and market historians for years to come — not just for their severity, but for what they taught the world about interconnected markets, investor psychology, and the impact of bold trade policy on global financial stability.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

About the Author

usa5911.com

Administrator

Hi, I’m Gurdeep Singh, a professional content writer from India with over 3 years of experience in the field. I specialize in covering U.S. politics, delivering timely and engaging content tailored specifically for an American audience. Along with my dedicated team, we track and report on all the latest political trends, news, and in-depth analysis shaping the United States today. Our goal is to provide clear, factual, and compelling content that keeps readers informed and engaged with the ever-changing political landscape.