Wall Street turns volatile: inflation data hits, stocks swing

US stocks rose as the S&P 500 rose 1.5% on Fed rate cut expectations, volatility in tech stocks and global markets after several days of turmoil. Today we will discuss about Wall Street turns volatile: inflation data hits, stocks swing

Wall Street turns volatile: inflation data hits, stocks swing

Wall Street has entered a period of pronounced volatility, with major U.S. stock indexes swinging sharply in response to a confluence of economic data, inflation signals, corporate earnings, and investor sentiment. The past several sessions have illustrated just how sensitive global markets have become to macroeconomic indicators and policy expectations, particularly surrounding inflation and future Federal Reserve action.

Recent trading sessions have been marked by wide intraday swings, retreating rallies, and a tug‑of‑war between optimism and caution. Key benchmarks such as the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite have fluctuated between gains and losses, reflecting the uncertainty gripping traders and institutional investors alike. The Cboe Volatility Index — widely known as Wall Street’s “fear gauge” — has surged at times, highlighting increasing expectations of turbulent markets ahead.

Inflation Data: Catalyst for Market Moves

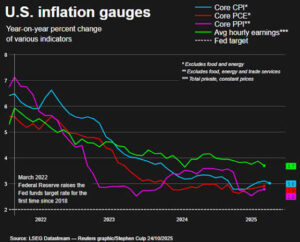

Inflation remains one of the most influential drivers of market behavior. Investors are closely watching inflation metrics, particularly the Consumer Price Index (CPI) and producer price figures. Even marginal changes in inflation data can sway market sentiment dramatically because they affect expectations around interest rate policy.

Markets reacted strongly in past sessions when inflation data showed less relief than hoped. For example, U.S. consumer spending rebounded less than expected while certain measures of underlying price pressures climbed — leading to sell‑offs in major tech stocks like Apple, Microsoft, and Amazon. That edition of inflation data heightened fears that tariffs could compound inflationary pressures, pushing inflation persistently higher and deterring the Federal Reserve from cutting interest rates.

Conversely, when inflation indicators come in softer than anticipated, markets have rallied. In previous months, when CPI figures undershot expectations — or the outlook for inflation cooled — the S&P 500 and other indexes climbed, driven by renewed investor optimism that rate cuts might be imminent. These inflation signals tend to create broad market shifts, with sectors such as real estate, cyclicals, and financial stocks responding differently based on their sensitivity to interest rates.

Today’s Market Movements

In the most recent sessions, mixed economic data has continued to unsettle markets. Wall Street indexes opened flat to slightly lower, reflecting investor hesitation ahead of key labor market and inflation reports. While some sectors showed gains, others dipped, underscoring the lack of consensus among traders about the direction of the market.

Losses in healthcare and energy stocks have offset gains in tech, while broader economic readings have painted a complicated picture — with unemployment ticking up even as job creation exceeded projections. This confusing economic backdrop has made it difficult for investors to draw firm conclusions about the trajectory of growth and inflation.

Wall Street’s mixed performance reflects cautious positioning ahead of upcoming inflation data releases. Investors often step back before such reports, awaiting clarity on price pressures and interest rate expectations. This positioning can itself heighten volatility, as market participants adjust portfolios and hedge risk.

Index Swings, Sector Divergences, and Stocks in Focus

The volatility on Wall Street isn’t just limited to headline numbers — it’s palpable in individual stocks and sectors. For example, in a recent trading session:

Stocks with strong recent rallies faced sharp pullbacks.

Some technology leaders experienced declines, contrasting with gains in cyclical or defensive sectors.

Larger intraday swings between highs and lows became more common, with the Nasdaq and Dow each seeing thousands of points of fluctuation in single sessions.

These dynamics have manifested in a divergence between sectors traditionally viewed as safe-havens (like utilities or consumer staples) and more growth-oriented segments — particularly technology — which have shown greater sensitivity to economic data and inflation expectations.

Why Inflation Drives Volatility

Inflation influences almost every corner of financial markets. When inflation rises faster than anticipated, central banks — notably the Federal Reserve — may respond with tighter monetary policy to contain price pressures. This typically means higher interest rates or delays in expected rate cuts. Higher rates raise the cost of capital, dampen consumer spending, and reduce future earnings valuations — all of which weigh on equities.

Equities often react negatively to higher inflation because:

Equity valuations are discounted at higher interest rates.

Consumer spending may soften as costs rise.

Corporate profit margins are squeezed by rising input costs.

Investor preference shifts toward inflation hedges or fixed income.

Conversely, when inflation data is cooler than expected, markets may anticipate rate cuts — which can lower borrowing costs and support higher equity valuations. These competing pressures create a feedback loop where every data point influences expectations and can lead to sudden market shifts.

Investor Sentiment and the Fear Gauge

Investor sentiment is often summarized through the VIX — the Cboe Volatility Index. When the VIX spikes, it suggests traders expect greater market turbulence. Amid recent economic ambiguity, the VIX has climbed, signaling deepening caution and positioning for potential swings ahead.

Historically, high VIX levels coincide with stronger correlations across stocks, where market movements tend to be more synchronized downward during fear periods. That phenomenon underscores how quickly fear can overwhelm fundamentals in the short term.

A high VIX doesn’t necessarily mean prolonged downturns — but it does suggest heightened uncertainty, which often leads to choppy price action and short-term trading volatility even amid longer-term trends.

Global Market Influences and Cross-Asset Dynamics

Wall Street does not operate in isolation; global markets and macroeconomic events amplify volatility. For example:

Asian and European markets have reacted to U.S. data, sometimes amplifying swings. In certain sessions, declines in global equities have coincided with Wall Street weakness, fueled by economic uncertainty ahead of major data releases.

Currency movements reflect safe-haven flows when equity markets wobble.

Safe-haven assets like gold and certain fixed-income instruments sometimes rally in concert with equity volatility.

These cross-asset connections help explain why volatility cascades across financial markets, not just in stocks.

What Traders Are Watching Next

Traders and analysts are keeping a sharp eye on several key indicators that could dictate market direction in the near term:

1. Inflation Reports

Inflation data — particularly CPI readings — remain central to market expectations for interest rates. Any indication that inflation is accelerating could delay rate cuts or signal further monetary tightening.

2. Federal Reserve Guidance

Comments from Federal Reserve officials and upcoming policy meetings will be scrutinized. Policy signals about rate direction can translate into pronounced market moves, as seen when dovish remarks have sparked rallies in the past.

3. Jobs Data

Labor market reports — including job growth, unemployment rates, and wage numbers — offer insight into economic health. Strong job data can reduce the likelihood of rate cuts, while weaker figures could increase the odds of future easing.

Lessons from Past Volatile Periods

Periods of volatility — whether it be the financial crisis of 2008, market turbulence during trade wars and tariff phases, or previous inflation shocks — provide context for current market behavior. These episodes remind investors that markets can oscillate sharply in the face of uncertainty, often without clear immediate trends.

Looking back at major historical corrections, it’s clear that volatility is not an anomaly but a feature of market cycles — especially when economic conditions shift abruptly or when policy changes occur unexpectedly.

Investor Strategies in a Volatile Market

In periods of volatility, seasoned investors often emphasize diversification, hedging, and risk management:

Diversify across asset classes to mitigate concentrated risk.

Use hedging instruments (like options or volatility ETFs) when appropriate.

Remain disciplined and avoid reactionary trading based solely on short-term price swings.

Focus on fundamentals — long-term earnings potential, strong balance sheets, and resilient business models can endure even turbulent phases.

These approaches aim to balance the impacts of short-term volatility with the pursuit of long-term growth and risk mitigation.

Conclusion: Volatility Is Here — But So Is Opportunity

Wall Street’s recent volatility underscores the sensitivity of financial markets to economic data, inflation readings, and investor psychology. While such turbulence can unsettle traders and long-term investors alike, it also presents opportunities for disciplined participants to reassess positions, capitalize on pricing dislocations, and build portfolios aligned with emerging economic realities.

As inflation data continues to shape expectations around monetary policy and economic direction, market swings are likely to persist. The key for investors is to approach volatility with informed perspectives and strategies grounded in both data and risk awareness.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

About the Author

usa5911.com

Administrator

Hi, I’m Gurdeep Singh, a professional content writer from India with over 3 years of experience in the field. I specialize in covering U.S. politics, delivering timely and engaging content tailored specifically for an American audience. Along with my dedicated team, we track and report on all the latest political trends, news, and in-depth analysis shaping the United States today. Our goal is to provide clear, factual, and compelling content that keeps readers informed and engaged with the ever-changing political landscape.