US housing shock continues: mortgage rates high, buyers disappear

The United States’ sluggish housing market will remain weak over the next year as higher mortgage rates reduce demand with modest demand. Today we will discuss about US housing shock continues: mortgage rates high, buyers disappear

US housing shock continues: mortgage rates high, buyers disappear

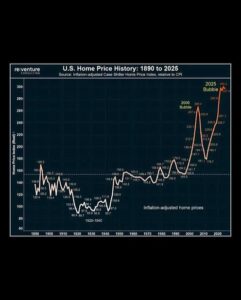

The United States housing market is undergoing one of its most disruptive periods in decades. What was once a fast-moving, seller-dominated environment has slowed dramatically, weighed down by high mortgage rates, stubbornly elevated home prices, and declining buyer confidence. Across the country, sales have stalled, listings sit longer, and many potential buyers have retreated entirely from the market.

This prolonged slowdown is not a temporary fluctuation. Instead, it reflects a deeper structural shift driven by interest rates, affordability pressures, and changing economic conditions. As borrowing costs remain high and purchasing power weakens, the American housing dream is becoming increasingly elusive for millions of households.

Mortgage Rates Remain the Central Obstacle

Mortgage rates are the single most important factor shaping today’s housing market. Although interest rates have eased slightly from their recent peaks, they remain significantly higher than levels seen during the pandemic housing boom.

For many buyers, the difference is dramatic. A mortgage rate above six percent means monthly payments that are hundreds — sometimes thousands — of dollars higher than what buyers would have paid just a few years ago. Even small fluctuations in interest rates can sharply reduce affordability, shrinking the pool of eligible buyers.

Unlike the ultra-low rates of 2020 and 2021, today’s borrowing costs have fundamentally altered the economics of homeownership. Buyers who could comfortably afford homes in the past now find themselves priced out, while others choose to delay purchasing in hopes of future relief.

Buyers Disappear as Demand Collapses

High mortgage rates have triggered a widespread pullback in buyer activity. Across the nation, home sales volumes have fallen to some of the lowest levels seen in decades. Mortgage applications have dropped sharply, reflecting hesitation among both first-time buyers and repeat purchasers.

Many potential buyers are simply stepping aside. Some are unwilling to commit to high monthly payments, while others fear buying at the wrong time amid economic uncertainty. The result is a market where listings attract fewer showings, bidding wars have largely vanished, and negotiations favor buyers — when they exist at all.

First-time buyers have been hit especially hard. Without the benefit of home equity, they face the full impact of rising interest rates and elevated home prices. Younger households increasingly find themselves locked out of ownership, extending the period they must remain renters.

Affordability Crisis Deepens

Affordability is at the heart of the ongoing housing shock. While mortgage rates have risen, home prices have not fallen enough to compensate. In many regions, prices remain near record highs, even as sales activity weakens.

This combination — high prices and high rates — has pushed affordability to historic lows. Monthly mortgage payments now consume a far greater share of household income than they did just a few years ago. Even households with stable jobs and solid credit struggle to qualify for loans without stretching their finances uncomfortably.

For many Americans, homeownership now requires either a significantly higher income, a larger down payment, or both. Those without family support or accumulated savings find the barriers nearly impossible to overcome.

The Lock-In Effect Freezes the Market

While buyers hesitate, sellers are also reluctant to move. Millions of homeowners refinanced or purchased homes when mortgage rates were exceptionally low. Giving up a mortgage rate below three percent to take on a new loan at double that rate feels financially irrational.

This phenomenon, known as the “lock-in effect,” has dramatically reduced the number of homes coming onto the market. Homeowners who might otherwise upgrade, downsize, or relocate choose to stay put instead.

As a result, housing inventory remains constrained, even as demand weakens. The market is trapped in a stalemate: buyers can’t afford to enter, and sellers don’t want to leave.

Listings Rise, Sales Stall

In some regions, active listings have begun to increase. However, this rise in inventory does not signal a healthy market recovery. Instead, many homes remain unsold for longer periods, and a growing number of sellers are pulling listings rather than lowering prices.

This behavior reflects unrealistic pricing expectations shaped by the pandemic boom. Sellers remember peak valuations and are hesitant to accept lower offers, even in a slower market. As a result, homes sit idle, transactions fail, and overall market activity remains muted.

The increase in canceled contracts and withdrawn listings highlights the uncertainty gripping both sides of the market.

Regional Differences Mask a National Trend

Housing conditions vary widely across the United States. Some regions have seen modest price corrections, while others remain stubbornly expensive. Areas that experienced rapid population growth during the pandemic now face sharper slowdowns as demand cools.

In more affordable regions, buyers have slightly more flexibility, but high mortgage rates still limit purchasing power. Expensive coastal and urban markets remain particularly challenging, with prices far exceeding what average incomes can support.

Despite these regional differences, the overarching trend is clear: elevated borrowing costs are suppressing demand almost everywhere.

Impact on the Broader Economy

The housing market plays a crucial role in the U.S. economy, and its slowdown has ripple effects far beyond real estate. Construction activity has softened as builders scale back new projects, wary of weak demand. Mortgage lending volumes have declined, affecting banks and financial institutions.

Housing-related spending — including furniture, renovations, and appliances — has also slowed. When fewer people move, the economic activity tied to those moves diminishes.

Additionally, slower home price growth limits the “wealth effect” that typically encourages consumer spending. Without rising home equity, households feel less confident making major purchases.

Federal Reserve Policy Offers Limited Relief

Recent interest rate cuts by the Federal Reserve raised hopes that mortgage rates would fall sharply. However, mortgage rates are influenced by long-term bond markets, not just short-term policy rates.

As a result, reductions in borrowing costs have been modest and inconsistent. While future rate cuts could help, most experts agree that mortgage rates are unlikely to return to the ultra-low levels of the past decade.

This means buyers may need to adjust expectations rather than waiting for a dramatic shift in financing conditions.

Generational Divide in Homeownership

The housing shock has intensified generational inequalities. Older homeowners, particularly those who bought before prices surged, benefit from low mortgage rates and substantial home equity. Younger generations, by contrast, face steep barriers to entry.

The average age of first-time homebuyers has risen significantly, reflecting delayed ownership. Many younger households feel trapped between high rents and unaffordable home prices, unable to build long-term wealth through property ownership.

This divide has long-term implications for economic mobility and financial stability.

Builders Caught in the Middle

Homebuilders face a difficult balancing act. On one hand, there is a long-term shortage of housing in the United States. On the other, current demand does not support aggressive new construction.

Many builders have slowed development or offered incentives such as mortgage rate buy-downs to attract buyers. While these strategies provide some relief, they cannot fully offset high interest rates and affordability constraints.

Without sustained demand, large-scale expansion of housing supply remains unlikely.

What Could Restore Balance?

A meaningful housing recovery will require several changes working together:

Mortgage rates need to decline further and remain stable

Home prices must align more closely with household incomes

Housing supply, particularly affordable and entry-level homes, must increase

Wage growth must improve purchasing power

Absent these shifts, the market is likely to remain slow, with low transaction volumes and cautious participants.

Outlook for the Coming Years

Most forecasts suggest that home prices will grow modestly rather than collapse. While this reduces the risk of a housing crash, it also means affordability will improve only gradually.

The housing market appears headed toward a prolonged adjustment period rather than a quick rebound. Buyers and sellers alike are adapting to a new reality where cheap financing is no longer the norm.

Conclusion

The ongoing U.S. housing shock reflects a fundamental reset after years of extraordinary conditions. High mortgage rates have reshaped buyer behavior, frozen seller activity, and exposed deep affordability challenges. Buyers have disappeared not because they lack interest, but because the financial math no longer works.

Until borrowing costs fall further, incomes rise, or prices adjust meaningfully, the housing market will remain stuck in a slow, cautious phase. For millions of Americans, the dream of homeownership is being postponed — not abandoned, but delayed by forces beyond individual control.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

About the Author

usa5911.com

Administrator

Hi, I’m Gurdeep Singh, a professional content writer from India with over 3 years of experience in the field. I specialize in covering U.S. politics, delivering timely and engaging content tailored specifically for an American audience. Along with my dedicated team, we track and report on all the latest political trends, news, and in-depth analysis shaping the United States today. Our goal is to provide clear, factual, and compelling content that keeps readers informed and engaged with the ever-changing political landscape.