Trump 2000 tariff: List 2025,Timeline,working,Economic and Political Peak

Trump’s $2000 tariff dividend plan promises payments financed by trade revenues to most Americans. Today we will discuss about Trump 2000 tariff: List 2025,Timeline,working,Economic and Political Peak

Trump 2000 tariff: List 2025,Timeline,working,Economic and Political Peak

The “Trump 2000 Tariff” refers to a sweeping set of trade measures introduced during Donald Trump’s second presidential term in 2025. The term itself symbolizes a new era in U.S. trade policy — a revival and expansion of Trump’s earlier “America First” economic strategy, centered on tariffs as tools of economic leverage, political influence, and national security.

In essence, the 2000 tariff is a universal import tax of 10 percent on nearly all foreign goods, accompanied by much higher “reciprocal tariffs” on certain nations such as China, the European Union, and Mexico. This new phase of tariffs marks both an economic experiment and a political statement, designed to reassert American dominance in global trade and manufacturing.

This article explores the full picture — from the tariff list and 2025 timeline to the mechanics of how it works, and finally, its economic and political peaks that have defined one of the most controversial trade policies in recent history.

1. The Trump 2000 Tariff: List and Overview

When President Trump returned to office in 2025, his administration moved quickly to reinstate and expand trade barriers. The 2000 tariff policy was introduced as a comprehensive and aggressive trade package with these main elements:

Key Tariff Measures

Universal Import Tariff (10%) – A flat 10% tax on nearly all imported goods entering the United States.

Reciprocal Tariffs – Countries running large trade surpluses with the U.S. faced much higher rates, some exceeding 30–40%, and in certain cases like China, reaching up to 125%.

National Security Tariffs – Sectors deemed critical to U.S. defense and industrial independence (such as steel, aluminum, semiconductors, and energy products) were targeted with additional tariffs under national security provisions.

Country-Specific Measures –

China: Punitive tariffs as high as 145% before a negotiated truce.

European Union: Average tariffs around 30% on autos and industrial goods.

Mexico & Canada: Moderate tariffs between 20–30% in disputes over labor and manufacturing rules.

South Korea, Vietnam, Japan: New tariff discussions based on “fair trade reciprocity.”

Revenue Collection: The policy aimed to generate substantial government income, estimated at over $2.5 trillion over a decade.

Tariff Dividend Proposal: A proposed annual payment of $2,000 to American households, funded by tariff revenues — turning the trade war into a domestic political incentive.

This broad and ambitious package of tariffs marked a shift from targeted trade enforcement (as seen in 2018–2020) to an all-encompassing global tariff regime.

2. Timeline of Major Tariff Actions

Early Foundations (2018–2020)

2018: Trump imposed tariffs on steel (25%) and aluminum (10%) using national security laws, sparking the first wave of trade wars.

2019: Tariffs expanded to hundreds of billions of dollars of Chinese imports. China retaliated with tariffs on American agricultural products.

2020: The Phase One trade deal paused escalation but left most tariffs intact.

The 2025 Resurgence – The “Tariff 2000” Era

January 20, 2025: Trump inaugurated for a second term. His administration promises to “reclaim American manufacturing.”

February 2025: The first round of new tariffs is announced — 10% on imports from China, Mexico, and Canada.

April 2, 2025 – The “Liberation Day” Announcement: Trump declares a sweeping 10% universal import tariff, effective April 5, on all countries. Reciprocal tariffs are announced to start the following week.

April 5, 2025: The universal 10% tariff officially takes effect. Importers begin adjusting contracts and supply chains.

April 9, 2025: Reciprocal tariffs begin — China’s tariff rate spikes above 80%, later climbing to 125% in retaliation cycles.

May 12, 2025: A temporary 90-day truce with China lowers rates to 30% on both sides.

July 2025: The U.S. announces new 30% tariffs on EU and Mexican goods, effective August 1.

October 2025: Trump and Xi Jinping meet in South Korea and extend the tariff truce until late 2026, stabilizing global markets.

This rapid escalation and partial de-escalation define the rhythm of the 2000 tariff policy — assertive, unpredictable, and deeply political.

3. How the Trump Tariff System Works

Understanding the Trump tariff regime requires examining its legal, economic, and political mechanisms.

A. Legal Foundations

The administration relied on several U.S. laws to justify broad tariffs:

Section 232 of the Trade Expansion Act (1962): Allows tariffs on imports that threaten national security.

Section 301 of the Trade Act (1974): Permits retaliation against countries engaged in unfair trade practices.

International Emergency Economic Powers Act (IEEPA): Grants the president emergency powers to restrict trade during crises.

By combining these authorities, the Trump administration established an almost unilateral ability to impose tariffs without new congressional approval.

B. Economic Mechanisms

Import Costs and Domestic Prices: Tariffs raise the cost of imported goods. While the goal is to make U.S. products more competitive, the higher import costs often trickle down to consumers as higher prices.

Revenue Generation: Tariffs collected at U.S. ports are added to the federal budget, turning trade policy into a source of fiscal income.

Trade Balance Adjustment: The goal is to reduce trade deficits by discouraging imports and encouraging domestic production.

Manufacturing Incentive: The administration claims tariffs will force global companies to build factories in the U.S., creating jobs and reshoring supply chains.

Tariff Dividend Concept: Trump proposed redistributing a portion of the tariff revenue directly to citizens — effectively linking trade policy to household income.

C. Political Strategy

Populist Appeal: Tariffs resonate with voters who feel harmed by decades of globalization and factory closures.

Negotiation Leverage: High tariffs are used as a bargaining tool to extract concessions in trade deals.

Symbolism of Power: Tariffs demonstrate economic nationalism and sovereignty, projecting the U.S. as a dominant global actor.

In practice, the Trump tariff system is as much a political symbol as it is an economic instrument.

4. The Economic and Political Peak

The 2000 tariff campaign reached its most dramatic and consequential period between April and July 2025, when universal tariffs were implemented and retaliations began worldwide.

A. Economic Achievements

Revenue Boom: Tariff collections surged, strengthening short-term federal finances. The Treasury reported record customs revenues within months.

Negotiation Wins: Several countries entered new trade talks with Washington, leading to concessions on manufacturing, intellectual property, and market access.

Public Messaging Success: The universal tariff policy was branded as a “patriotic tax,” positioning the U.S. as reclaiming control over its economy.

Manufacturing Optimism: Some U.S. industries, particularly in steel, defense, and energy, saw renewed investment pledges due to tariff protection.

B. Economic Costs and Side Effects

Inflationary Pressure: Consumer prices rose sharply across imported goods — electronics, vehicles, clothing, and household items saw price spikes between 5–20%.

Reduced Real Income: Economists estimate that household purchasing power declined as costs passed to consumers.

Investment Slowdown: Global uncertainty caused businesses to delay investments. Stock markets experienced volatility in early 2025.

Retaliation Losses: Export-oriented sectors such as agriculture and automotive faced retaliatory tariffs abroad, cutting into sales.

Global Trade Disruption: The new tariff wave reduced global trade volumes and complicated supply chains, particularly for companies reliant on Chinese manufacturing.

C. Political Peaks and Turning Points

Liberation Day Speech (April 2025): A defining political moment where Trump framed tariffs as a “second American Revolution” for economic independence.

Tariff Dividend Announcement: The promise of a $2,000 per-person dividend turned a trade war into an election-year talking point, resonating deeply with working-class voters.

China–U.S. Truce (May 2025): This 90-day pause showcased Trump’s negotiation style — escalate hard, then pivot to partial compromise.

European Tensions (August 2025): Tariffs on EU goods triggered new disputes but also brought Europe back to the negotiation table.

Politically, this period marked Trump’s ability to use trade as a domestic campaign weapon and a diplomatic bargaining chip simultaneously.

5. Economic and Global Implications

The ripple effects of the 2000 tariff extended far beyond U.S. borders.

Global Trade Impact

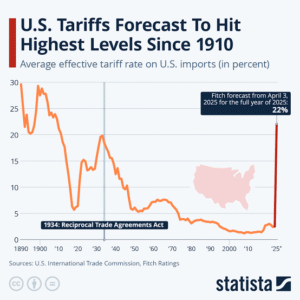

Average U.S. tariffs rose from around 3% to over 20% in 2025.

Global supply chains were forced to reorganize, with companies shifting production from China to Vietnam, India, and Mexico.

The World Trade Organization faced renewed stress as the U.S. bypassed multilateral rules to enforce national tariffs unilaterally.

Domestic Economic Outcomes

Short-Term Gains: Some factories reopened or expanded. Tariff revenue provided budgetary relief.

Long-Term Risks: Inflationary effects, decreased global investment, and trade retaliation began to offset the gains.

Industrial Concentration: Protection benefited large manufacturers more than small businesses, leading to unequal results across industries.

Global Political Consequences

U.S. relations with allies became strained. The European Union considered counter-tariffs on U.S. agricultural products.

China adopted a dual-track approach: partial negotiation with Washington while deepening trade partnerships with Russia and Southeast Asia.

Emerging markets like India, Indonesia, and Brazil capitalized on the reshuffling by attracting manufacturing investment diverted from China.

6. Critical Reflections: Strengths and Weaknesses

Strengths

Revenue Source: Tariffs transformed trade policy into a fiscal instrument, reducing reliance on income taxes.

Negotiation Power: The policy forced countries to reconsider trade deficits with the U.S.

Domestic Appeal: Tariffs reinforced the image of Trump as a defender of American jobs and sovereignty.

National Security Alignment: Protecting key sectors was presented as essential for strategic independence.

Weaknesses

Consumer Burden: The immediate effect of higher import costs fell on consumers.

Export Retaliation: U.S. farmers and exporters suffered from retaliatory measures abroad.

Legal Controversy: Critics questioned the legality of using emergency powers for blanket tariffs.

Economic Distortion: By interfering with global supply chains, tariffs created inefficiencies and shortages in key sectors.

WTO Challenges: The international system of trade arbitration was weakened, undermining long-term stability.

7. Future Outlook

Looking ahead, the Trump 2000 tariff policy will likely continue to shape global trade for years. Several possible outcomes are anticipated:

Tariff Normalization: Negotiated reductions could stabilize global trade but keep baseline tariffs higher than pre-2025 levels.

Sectoral Expansion: New tariffs on technology, pharmaceuticals, and rare earth elements could emerge under national security justifications.

Shift in Manufacturing: The relocation of production to the U.S. and allied countries could strengthen North American industrial integration.

Political Durability: Tariffs remain a centerpiece of populist economic policy — likely to influence future administrations, regardless of party.

Global Realignment: Nations diversifying trade relationships may gradually reduce dependency on the U.S. market, reshaping the world trade map.

Conclusion

The Trump 2000 Tariff represents one of the boldest economic experiments in modern U.S. history — a return to protectionism, nationalism, and direct state involvement in trade policy. Introduced in 2025, the policy blended economics and politics into a single narrative of “economic independence” and “fair trade.”

From the 10% universal import tax to the reciprocal tariffs on China and the European Union, the policy created short-term wins in federal revenue and political popularity but also stirred inflation, retaliation, and global uncertainty.

Economically, the 2000 tariff achieved its peak in early 2025, redefining trade norms and reshaping global supply chains. Politically, it reinforced Trump’s populist base and projected American assertiveness abroad. Yet its long-term success remains uncertain, as the global economy continues to grapple with the consequences of high tariffs, disrupted trade flows, and shifting alliances.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

About the Author

usa5911.com

Administrator

Hi, I’m Gurdeep Singh, a professional content writer from India with over 3 years of experience in the field. I specialize in covering U.S. politics, delivering timely and engaging content tailored specifically for an American audience. Along with my dedicated team, we track and report on all the latest political trends, news, and in-depth analysis shaping the United States today. Our goal is to provide clear, factual, and compelling content that keeps readers informed and engaged with the ever-changing political landscape.