Dow Jones and Nasdaq futures live: S&P 500,current graph,Today news

Stock market today: SP 500 falls for fifth day as focus remains on Powell’s speech. Today we will discuss about Dow Jones and Nasdaq futures live: S&P 500,current graph,Today news

Dow Jones and Nasdaq futures live: S&P 500,current graph,Today news

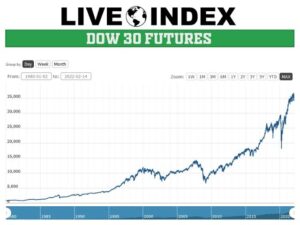

The global financial markets are once again at a pivotal moment, and U.S. stock index futures are showing signs of cautious optimism mixed with uncertainty. The Dow Jones Industrial Average (DJIA), Nasdaq 100, and S&P 500 futures are crucial indicators of investor sentiment and economic expectations ahead of each trading session.

As of today’s readings, the futures markets are moving in a tight range — reflecting investors’ hesitation as they digest earnings results, macroeconomic data, and shifting Federal Reserve policies. Understanding what drives these movements, and what they imply for the broader stock market, is essential for traders, investors, and analysts alike.

This article provides a detailed, real-time view of the current trends in Dow Jones and Nasdaq futures, a look at S&P 500 performance, and a breakdown of key factors shaping the market today.

Section 1: Current Market Overview

Dow Jones Futures

Dow Jones futures are currently showing slight downside pressure. The index has been hovering near record highs in recent weeks, but momentum appears to be cooling. Investors are weighing the resilience of industrial and blue-chip companies against persistent inflationary concerns and elevated interest rates.

Short-term volatility remains contained, suggesting that traders are not yet pricing in any major shocks. However, with the ongoing uncertainty in global supply chains, energy prices, and political developments, many analysts are adopting a cautious outlook for the near term.

S&P 500 Futures

S&P 500 futures are flat to modestly higher. This reflects a delicate balance between optimism in certain sectors — particularly technology and healthcare — and weakness in cyclical industries. The index continues to hover near its all-time highs, supported by strong corporate earnings and liquidity in the system, yet tempered by concerns about economic slowdown.

A flattening futures curve suggests that traders expect a period of consolidation rather than an immediate breakout. Many investors are looking for clearer signals from upcoming inflation and employment reports before making decisive moves.

Nasdaq 100 Futures

Nasdaq futures are showing mild gains, signaling that tech investors remain cautiously optimistic despite mixed earnings reports. Major technology stocks continue to drive the broader market’s performance. However, given their sensitivity to interest rate expectations, the Nasdaq’s direction remains closely tied to Federal Reserve policy outlooks.

If inflation data cools and the Fed signals a willingness to ease monetary policy in the coming months, Nasdaq futures could experience a strong upward move. Conversely, any hint of renewed tightening could trigger a quick reversal.

Section 2: Key Drivers Behind Today’s Market Moves

1. Federal Reserve Policy and Interest Rates

The Federal Reserve’s stance on interest rates remains the single biggest driver for futures markets. Investors are currently betting on the timing of potential rate cuts, but mixed inflation readings have made the picture less clear.

If the Fed maintains higher rates for longer, borrowing costs will continue to pressure corporate profits and slow economic expansion. Futures markets typically react immediately to any change in rate expectations — and right now, they’re showing hesitation rather than conviction.

2. Inflation Data and Economic Indicators

Recent inflation readings show signs of moderation, but prices remain above the Fed’s 2% target. Energy costs and housing expenses are key contributors to ongoing inflation. Futures markets are reflecting this mixed picture — optimism about a cooling trend, but anxiety that the progress may not be fast enough to justify aggressive rate cuts.

Upcoming inflation reports and labor market data will be crucial in determining the next leg of the futures market’s direction.

3. Corporate Earnings and Sector Performance

The latest corporate earnings season has produced mixed results. While many large-cap companies in the technology and finance sectors reported solid profits, others in retail and manufacturing showed slower growth due to cost pressures.

Nasdaq futures, heavily influenced by mega-cap tech names, are particularly reactive to earnings surprises. A strong beat from major players like Apple, Microsoft, or Nvidia can lift the entire futures complex — while a miss can send futures sliding in seconds.

4. Geopolitical Uncertainty

Global tensions — whether from trade disputes, supply chain disruptions, or geopolitical conflicts — continue to create ripples in financial markets. Oil prices remain a significant factor, as energy costs directly affect inflation expectations and corporate margins.

Futures traders monitor geopolitical headlines closely, as any escalation can trigger flight-to-safety moves into bonds or defensive equities, putting downward pressure on stock index futures.

5. Technical and Algorithmic Trading

From a technical perspective, the futures charts for all three major indices show a pattern of consolidation near their respective resistance zones. Traders are watching closely for a confirmed breakout or breakdown.

Algorithmic trading has amplified these technical dynamics — sharp intraday reversals often occur when futures hit key moving averages or support levels. Momentum indicators currently suggest a neutral to mildly bullish setup, but with limited upside until fresh catalysts emerge.

Section 3: Futures Charts and Technical Outlook

S&P 500 Futures Chart Insights

The S&P 500 futures chart indicates a sideways movement over recent sessions. The price action has been forming a narrow band between support and resistance levels, suggesting indecision. The moving averages remain upward-sloping, showing that the broader trend is still bullish, but momentum indicators such as RSI and MACD are flattening out.

If futures break decisively above resistance, the index could target new highs. However, a breakdown below support could signal a short-term correction phase.

Dow Jones Futures Technical Picture

Dow futures show moderate downside pressure but remain within a healthy uptrend channel. The index has found repeated support at the 50-day moving average, which has acted as a safety net for buyers. Traders will be watching whether this support holds; a breach could open the door to a deeper retracement.

The next upside target for Dow futures is projected around the recent highs, while key support lies roughly 2% below current levels.

Nasdaq Futures Momentum Trends

Nasdaq 100 futures continue to outperform on a relative basis, though gains have slowed compared to earlier in the year. The index remains above major moving averages, reflecting sustained buying interest in tech stocks.

However, recent sessions have seen smaller price ranges — a sign of consolidation. Traders are cautious, waiting for either a bullish breakout or a signal of trend exhaustion.

Section 4: Today’s Top Market News

Several key headlines are shaping futures sentiment today:

Mixed Corporate Earnings – Some major U.S. companies have posted solid results, while others issued cautious guidance for the coming quarters. This uneven performance is creating a tug-of-war effect on futures.

Oil Prices Rising – Higher crude prices have reignited inflation concerns, leading some investors to expect that the Federal Reserve will maintain a restrictive policy stance for longer.

Tech Stocks in Focus – The technology sector continues to dominate market headlines, with innovation and AI-related companies drawing significant attention from traders.

Global Economic Outlook – Forecasts from the IMF and other institutions suggest moderate global growth ahead, but persistent inflation and supply disruptions remain risks.

Bond Yield Movements – Treasury yields have ticked up slightly, reflecting expectations that the Fed will be cautious before easing policy. Rising yields typically weigh on equity futures, especially the Nasdaq.

Together, these developments are keeping futures markets in a state of equilibrium — neither fully bullish nor overtly bearish.

Section 5: What to Watch in the Short Term

Looking ahead, several upcoming events could have a significant impact on futures:

Economic Data Releases – Key reports on inflation, employment, and consumer spending will determine short-term market direction.

Federal Reserve Statements – Any change in tone regarding interest rates could move futures instantly.

Earnings Announcements – Continued earnings from tech and financial firms will set the tone for risk appetite.

Global Developments – News from Europe and Asia, particularly around trade and energy, can affect overnight futures activity.

Technical Breakouts – Watch for significant moves above or below resistance and support zones, which can trigger strong follow-through trading.

Section 6: Strategic Outlook for Traders and Investors

For Day Traders

Short-term traders should expect choppy price action. Futures are moving within narrow ranges, so identifying intraday breakout levels is key. Scalping strategies and tight risk management are advisable.

For Swing Traders

Swing traders can monitor broader patterns — especially how futures respond to economic data releases. If futures show consistent higher lows and break resistance levels, that could signal a short-term rally opportunity.

For Long-Term Investors

Long-term investors can use futures trends as an early signal of potential market direction. While volatility remains, the underlying economy is still expanding, suggesting that long-term portfolios can remain invested but diversified.

Risk Management Tips

Use stop-loss orders to manage downside exposure.

Diversify positions to offset sector-specific volatility.

Avoid over-leveraging when trading futures in uncertain environments.

Track volume and open interest for confirmation of directional strength.

Section 7: Broader Economic Context

Despite the current uncertainty, the overall U.S. economy remains relatively stable. Employment levels are strong, consumer spending continues to support growth, and corporate balance sheets are generally healthy.

However, inflation remains the primary obstacle. While it has cooled from peak levels, the pace of decline has slowed. The Federal Reserve’s cautious tone indicates that rate cuts may not arrive as soon as some market participants hope.

This tug-of-war between optimism and restraint is exactly what’s being reflected in Dow, S&P, and Nasdaq futures right now — a market waiting for a decisive signal to break out of its holding pattern.

Section 8: Market Sentiment and Investor Psychology

Investor sentiment is neutral to mildly positive. The Fear & Greed Index shows a balanced mood — not extreme enough to indicate panic selling or euphoria buying. Institutional investors are positioning cautiously, maintaining liquidity and hedging against potential volatility.

Retail participation remains strong, driven by optimism in technology and AI-related sectors. Yet, retail investors are also increasingly aware of macroeconomic headwinds, leading to a more measured approach than in previous bull runs.

Section 9: Forecast and Outlook

Given the data currently available, the short-term outlook for U.S. index futures can be summarized as follows:

Dow Jones Futures: Neutral to mildly bearish. Expect sideways trading until a new macro catalyst emerges.

S&P 500 Futures: Stable with potential for limited upside. Consolidation likely before another breakout attempt.

Nasdaq Futures: Slightly bullish bias, supported by strong tech performance but vulnerable to rate fluctuations.

In the medium term, the direction of futures will depend heavily on inflation trends, central bank communication, and corporate profitability. If inflation continues to moderate and the Fed begins to ease policy, futures could see a sustained rally into the next quarter.

Conclusion

The Dow Jones, Nasdaq, and S&P 500 futures today paint a picture of a market in balance — cautious but not fearful, optimistic but not exuberant. Traders and investors are watching for clarity on interest rates, inflation, and earnings before committing to new positions.

In this environment, patience and discipline are key. Futures markets are likely to remain range-bound in the short term, but beneath the surface, strong economic undercurrents suggest that once a clear catalyst emerges, a significant move — up or down — could follow.

For now, the best strategy is to stay informed, watch the charts closely, and remain agile. The next major move in U.S. futures could define the tone for global markets in the weeks ahead.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

About the Author

usa5911.com

Administrator

Hi, I’m Gurdeep Singh, a professional content writer from India with over 3 years of experience in the field. I specialize in covering U.S. politics, delivering timely and engaging content tailored specifically for an American audience. Along with my dedicated team, we track and report on all the latest political trends, news, and in-depth analysis shaping the United States today. Our goal is to provide clear, factual, and compelling content that keeps readers informed and engaged with the ever-changing political landscape.