Lisa Cook Fights Back: Inside the Lawsuit That Could Reshape U.S. Economics

Trump demanded to fire cook on 25 August, but a federal judge ruled last week that the expulsion was probably illegal. Today we will discuss about Lisa Cook Fights Back: Inside the Lawsuit That Could Reshape U.S. Economics

Lisa Cook Fights Back: Inside the Lawsuit That Could Reshape U.S. Economics

In late 2025, Lisa Cook, one of the Governors of the Federal Reserve Board, has become the center of a legal firestorm. Her battle isn’t just personal; it strikes at the heart of how independent U.S. economic policy is defined, and who controls central banking in times of political tension. The case—Cook v. Trump—has implications for the balance of power between the executive branch and independent institutions, for market confidence, and for how U.S. monetary policy might be shaped in the future.

This article delves into the origins of the suit, the legal arguments, the stakes for U.S. economic policy, and what the outcome may mean for the future of the Fed’s independence.

Who is Lisa Cook, and What Happened

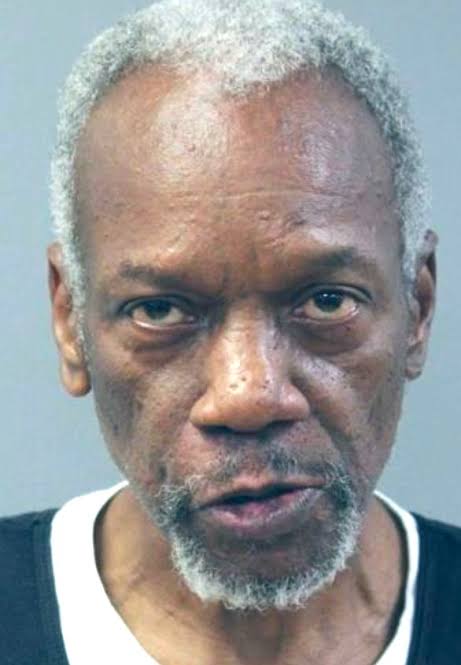

Lisa DeNell Cook is a Federal Reserve Governor appointed in 2022, serving a long term supposed to run until 2038. She is a distinguished economist, and notably the first Black woman to serve on the Fed’s Board of Governors in its history.

On August 25, 2025, President Donald Trump issued a letter purporting to remove Governor Cook “for cause” from her position on the Fed. The stated reason was allegations of mortgage fraud: that Cook had applied for mortgages on properties (in Michigan, Georgia, and Massachusetts) in 2021, prior to her confirmation as a Fed Governor, listing more than one as her primary residence.

Cook immediately responded that she had done nothing improper, denied the fraud allegations, and declared that even assuming arguendo any possible misstatements—clerical or otherwise—they did not rise to “cause” under the law. She also initiated a lawsuit challenging her removal, seeking an injunction to block the firing and a declaratory judgment that the removal was unlawful.

The Legal Framework: What Does “For Cause” Mean?

At the heart of this case is the Federal Reserve Act of 1913, which governs the appointment and removal of Fed Governors. Key points:

-

Fed governors have fixed terms.

-

Removal by the President is allowed only for cause. This clause sets a high bar.

-

“For cause” has generally been understood to involve misbehavior or dereliction during office—inefficiency, neglect of duty, misconduct—but not mere errors or allegations from before appointment.

Cook’s legal team argues that:

-

The alleged conduct predates her confirmation, so it cannot be “during office” or part of her duties.

-

Even if there were misstatements, they are unsubstantiated and do not meet the legal threshold of “cause.”

-

She was denied due process: no notice, no hearing, no chance to respond before her removal was announced.

Meanwhile, the administration claims that the mortgage fraud allegations are serious, and that misrepresentations in obtaining mortgages—if proven—could undermine her credibility in a sensitive position overseeing financial institutions. Thus, they argue that “cause” exists, or at least that the matter merits removal.

The Court’s Reaction So Far

A federal judge—Judge Jia M. Cobb—has issued a preliminary injunction blocking Cook’s removal while the case proceeds. The judge determined that the allegations do not, at this stage, meet the legal standard required for cause under the Federal Reserve Act, especially since they relate to acts before she took office and there is no evidence of misconduct in office.

Consequently, Cook remains on the Board of Governors for now. The legal battle is expected to escalate—possibly up to the U.S. Supreme Court—given the constitutional and structural issues involved.

Economic & Institutional Stakes

Why does this case matter beyond Cook herself? Several big issues are at play:

1. Independence of the Federal Reserve

The Fed is designed to be insulated from direct political pressure so it can make decisions about interest rates, inflation, money supply, etc., based on economic, not political, logic. If a president can remove a Fed Governor for pre-appointment conduct (or conduct loosely alleged, or before an opportunity for due process), it weakens that insulation.

A ruling that broadens what “cause” means could give future presidents more power to influence the Fed by removing or threatening removal of unfavorable governors.

2. Credibility & Market Confidence

Financial markets value predictability, especially around monetary policy. If Fed governors can be removed for political reasons, markets may become more volatile:

-

Interest rate expectations may swing based on political maneuvering rather than economic signals.

-

Businesses and investors may worry about regulatory consistency.

-

Inflation expectations could be affected if there’s a perception that Fed policy will tilt toward political preferences (e.g. lower interest rates before elections).

3. Legal Precedent

This is historically novel. Never before has a U.S. President attempted to remove a Fed Governor for “cause” under these circumstances. The court’s interpretations here may set precedent for what “cause” means, what standards of procedure (notice, hearing) are required, and how broadly presidential removal power extends over independent agencies.

4. Policy Impacts (Interest Rates, Inflation, Regulation)

Changing the composition of the Board of Governors could shift the balance on monetary policy decisions. President Trump has been publicly critical of relatively high interest rates under Chair Powell and others, and seeks more aggressive rate cuts. Altering the board’s membership might help support his policy preferences.

Moreover, any court ruling that politicizes Fed governance risks creating new pressures on how monetary policy is set—potentially leading to decisions that favor short-term political needs over long-term economic stability.

Challenges and Counterarguments

While Cook has strong legal arguments, there are serious challenges:

-

Allegations must be investigated and proven: The White House and associated agencies like the Federal Housing Finance Agency (FHFA) have flagged specific instances (property in Michigan, Georgia, etc.). If proven, these may have some legal weight.

-

Political pressure: The administration has both motive and power to attempt to push the removal. Even if Cook wins in court, the legal costs, time, and institutional tensions may be significant.

-

Precedents might not be completely clean: While “for cause” removal is usually reserved for misconduct in office, definitions of cause have sometimes been broad in other statutory contexts. Much depends on how the courts interpret and perhaps extend prior case law.

Potential Outcomes

Here are several scenarios and what each could mean:

| Scenario | Likely Outcome | Implications |

|---|---|---|

| Cook wins decisively in lower court, courts affirm narrow definition of “cause” | She remains, removal blocked; strong precedent for Fed independence preserved | Maintains status quo; emboldens Fed Governors; political pressure reduced; markets reassured |

| Cook loses, court sides with broad “cause” definition or allows pre-appointment allegations | She is removed; future Fed Governors may be vulnerable to politically motivated removal; future presidents gain removal leverage | Could politicize Fed; increases risk of policy instability; markets may embed risk premium; harder for Fed to resist political pressure |

| Supreme Court takes up case | Final, binding ruling on what “cause” includes and what legal process must be followed | A landmark decision; shapes broad institutional powers; affects other independent agencies similarly |

| Settlement or partial compromise | Perhaps Cook stays but with limitations; process reforms; clarity added via legislation or regulations | May resolve some uncertainty but leaves open possibility of politics influencing central banking |

Broader Context & Risks

-

Political polarization is increasingly affecting institutions previously seen as technocratic and independent. This case is one more flashpoint.

-

Monetary policy pressures are intense: inflation, supply-chain disruptions, labor market distortions, geopolitical risks. Presidents often wish lower rates for political popularity; central bankers may resist until conditions warrant. A weakened Fed could bend.

-

Public trust: If the public sees the Fed as just another political tool, trust in its decisions (which rely on credibility) may erode.

-

International consequences: U.S. credibility on inflation, interest rate stability, and central bank independence matter globally. Other central banks, investors, creditors watch carefully.

What’s Next

-

The lawsuit will continue through the courts. Upcoming hearings will examine:

-

Whether Cook was given due process.

-

Whether the alleged misrepresentations (if any) are sufficiently serious and material to constitute “cause.”

-

Whether pre-appointment conduct can ever be cause for removal.

-

-

The Supreme Court is likely to be involved if the lower courts diverge or if there is a significant constitutional issue.

-

Legislators may weigh in. Congress could amend the Federal Reserve Act, or clarify standards of removal, particularly if this case reveals gaps.

-

Markets will continue to monitor whether the Fed remains stable in its operations—interest rate decisions, policy communications, etc.—amidst legal and political turbulence.

Conclusion

Lisa Cook’s fight is more than a personal defense—it is a test of America’s institutional architecture. The issue is whether the Fed, a pillar of economic stability, remains insulated from political firestorms, or whether political power reaches ever further into previously protected institutions. The final decision could reshape U.S. economics not merely by altering one seat on the Fed’s Board but by redefining how and by whom economic policy is constrained—or directed.

It may be too soon to know how the courts will rule, but the stakes are high: the outcome will reverberate through financial markets, through the confidence people place in the Fed, and through how future presidents and governors see their powers and limits.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

About the Author

usa5911.com

Administrator

Hi, I’m Gurdeep Singh, a professional content writer from India with over 3 years of experience in the field. I specialize in covering U.S. politics, delivering timely and engaging content tailored specifically for an American audience. Along with my dedicated team, we track and report on all the latest political trends, news, and in-depth analysis shaping the United States today. Our goal is to provide clear, factual, and compelling content that keeps readers informed and engaged with the ever-changing political landscape.